Don't let the technicals scare you.

After all, it's the technicals that will ultimately help you pick winning biotech stocks.

And at the end of the day, that's all that really matters.

So let's get to it. Because there's a ton of money to be made in biotechs, and I'm going to show you how to make it.

12 to 18 Months

One of the first things to do before investing is to determine the overall health of a given sector within the context of the broad stock market indices.

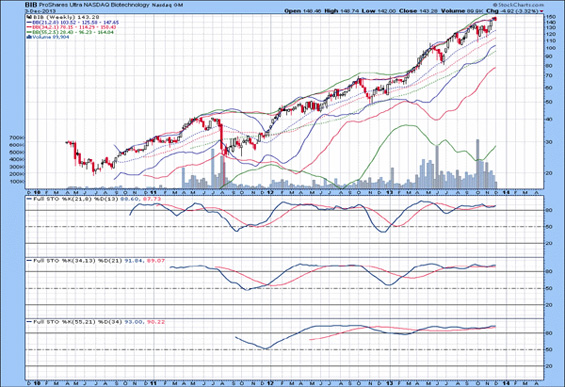

The first chart below is BIB – the Proshares Ultra NASDAQ Biotechnology ETF.

Ever since I first recommended biotech stocks two years ago, they have been on a tear. Although there is no indication of a top at present, chances are one is due within 12-18 months if my technical analysis of the broad stock market indices is correct.

The BIS, or Proshares UltraShort NASDAQ Biotechnology ETF, is the complete opposite of BIB, as shown below. There is no indication that a bottom has been put in place, but when there is a reversal (12–18 months out), cash can be deployed into the new trend.

Playing ETFs can be profitable as per above, as money can be shifted out of a sector that is overbought and into the bear fund to generate money in the other direction.

But while buying ETFs is easy (the fund manager has done the work to balance the fund), purchasing individual stocks requires some detective work. I have generated some notes below on how to identify biotech stocks that can be separated from their peers.

Technological Superiority

Biotech companies first came onto the scene to produce human proteins to aid in treating genetic disorders or disease—producing products like EPO, hGH, and GM-CSF.

Today, the landscape has changed, and the industry is focused on monoclonal antibody production.

You see, everybody has an immune system with a polyclonal (many different types) antibody population. Monoclonal (literally meaning "one") antibodies are specific to target diseases such as cancer, high cholesterol, or autoimmune diseases, just to name a few. This market has been saturated by many of the major biotech companies, so market penetration is very difficult unless someone has a potentially new blockbuster molecule.

But there are two other new technologies that are rapidly being developed for treating disease and preventing infection—namely vaccines (the earliest phase of biotech started over 100 years ago by Louis Pasteur) and RNAi (RNA interference).

Vaccines traditionally have been developed with large volumes of viruses that have been inactivated and are injected into people to help them develop immunity. But new technologies are starting to become DNA-based so that the generated immune response is stronger on many levels. This area holds a significant amount of promise. It could revolutionize the way vaccines are administered in the future, and if the trend continues, it could do what the automobile did to blacksmiths.

RNAi is a very hot area that involves segments of lab-derived RNA being created to bind to very specific sections of RNA destined for translation into a protein causing an illness.

For many years, science could not account for the vast tract of DNA in the human genome associated with protein production (we have some 30,000 different genes that go into making proteins). Research over the past 15 years has shown that over 100,000 different RNAi molecules potentially exist to help regulate overall expression, much like an extremely complex set of traffic lights. As one may imagine, RNAi research is focusing on inactivating genes that cause illnesses such as cancer.

The Most Valuable Asset

Intellectual property (IP) is one of the most important and valuable assets a company has. IP essentially gives someone a monopoly for producing a product against certain indications for up to 20 years. Finding companies with great ideas that follow through with investing in patent protection creates a potential short list of investments, as a successful product could have exclusivity in the marketplace.

When a patent nears expiration, it opens the market up to "other companies" to produce "generic" versions aside from the brand name that has dominated a given space. Up to 10 years before a patent expires, "other companies" will identify which products stand to generate the most revenue and begin developing products for future release that coincides with patent expiration. To circumvent this, most companies take the following steps to protect their product lines:

- Product Differentiation: Fulfill unmet market need that provide an advantage over competitors (e.g. Higher dosages, more convenient methods of administration).

- Alternative Formulas: Continued release of formulations to extend a product life and increase market penetration (e.g. Proteins often have modified glycosylation patterns to increase retention within the body, thereby requiring fewer injections).

- Efficacy Improvement: This was already covered, but it involves using a product to treat new indications to further extend product penetration and life (through issuance of new patents).

- First Mover Advantages: Having a single product on the market creates brand loyalty, which makes purchasing a newer version less likely.

- Proprietary Technology: Utilizing technologies that are difficult to duplicate or blocks competition entry. This item can involve patenting a formulation for maintaining product stability or controlling a new technology/trade secret that essentially prevents a competitor from entering a given market space.

Research and Development Is Key

This is probably one of the most critical areas to consider when examining potential companies to invest in. Every company that has a product on the market requires a pipeline to ensure new products are continually being developed to replace the revenue stream that stands to be significantly impacted when existing products comes off of patent.

To have a pipeline, R&D is required in order to scout out new products or to further develop new technologies. This is where new life is breathed into companies, and it requires a substantial commitment.

One huge metric to examine is the R&D investment/total revenue ratio, or what percentage of money out of the total revenue base a company reinvests into R&D. Generally, the greater the commitment, the greater the future profit.

This is not always the case, but like anything, a greater effort usually results in greater rewards.

A number of years ago, one large biotech company had a huge number of products on the market. It became a lazy fat cat, committing very little into its R&D program. When patents for many of its lead drugs expired, huge layoffs and a total business restructuring was required to fix its dilemma.

Putting It All Together

Although not discussed in this piece, the main factors for determining a great company still exist:

- Great management

- Strong balance sheet

- Paying dividends

- Diverse operations

By taking standard metrics into account, along with some of the unique aspects of biotech, you can select a set of potential worthy stocks. When playing the biotech sector, it is always worth it to put most allocated funding into the larger blue chip stocks and reserve no more than 10% for small cap stocks.

There's a lot of talk at present about a top, with everyone trying to justify why it is due now. We have seen analog charts of 1987, 1938, and now 1929 to illustrate how we are just on the brink of going over a cliff. The current bull market will be over when the last bear has been skinned, and from my view, there are still a lot of bears running around in their fur coats right now.

So in the meantime, don't ignore the biotech sector.

Until next time. . .

David Petch

Wealth Daily

** David Petch has been providing high-end analysis for a select group of investors since 2003. His technical analysis focuses on Bollinger bands, stochastics (using daily, weekly and monthly charts), as well as extensive Elliott Wave analysis. His recent discovery of the Contracting Fiboancci Spiral the broad stock market indices are trapped in has indicated every major top since its inception in 1932. Recently, this theory was expanded by noting that a chiral inversion occurred recently within the CFS cycle. David holds a BScH and MSc in Microbiology.