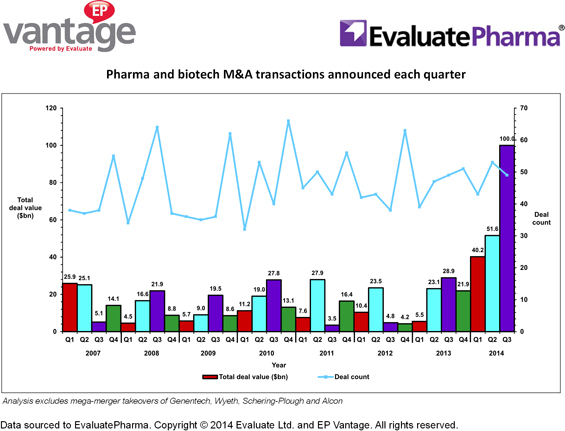

The summer slowdown was officially cancelled this year as $100B of third-quarter mergers and takeovers blasted the previous period into oblivion—or at least this is how things stood before news emerged that AbbVie was having second thoughts about buying Shire.

Shabbvie accounts for more than half of the third-quarter transaction value, so if, as seems likely, the current iteration of the deal falls apart the immediate effect is obvious: Pharma and biotech M&A bankers will have had another great quarter, rather than a truly exceptional one (see tables below).[Editor's note: After publication, Abbvie announced that it would no longer pursue the Shire merger.]

The $51.6B of M&A deals announced in the second quarter was already the most in terms of value since at least 2007, driven in no small part by US companies' drive to shelter offshore cash from the taxman (Huge second quarter for M&A sets 2014 on track for record year, July 9, 2014).

If anything the tax inversion rush has accelerated in recent months—ironically helped by growing concerns that U.S. action would soon make the gaining of such advantages impossible, a view that focused acquirers' minds in terms pushing to get deals done before the curtain.

Clearly, as soon as the US Treasury started making noises in September about tightening rules against US corporations domiciling in lower-tax jurisdictions, the heat was on to close the Shire deal, which had been agreed in July (AbbVie-Shire pact wobbles as inversion backlash spreads, October 15, 2014).

As the chart above shows, AbbVie/Shire roughly doubled the quarter-on-quarter value of announced M&A transactions. This analysis excludes mega deals like Wyeth and Schering-Plough because of the tendency for big pharma consolidation to skew the numbers. However with the Shire transaction topping $50B, this point of differentiation is arguably losing its relevance.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

That said, the third quarter was not all about tax inversion. Roche's surprisingly pricey $8.3B acquisition of InterMune was clearly driven by strategic rather than financial considerations, while the rationale behind Mylan's $5.3B move on Abbott's generics business was probably 50/50.

And there is another interesting trend beneath the huge financial deal volume: the fact that underneath it all the actual number of deals done each quarter has remained pretty constant. This is clearly due to the growing number of ever bigger transactions, which has seen the average price per deal climb from $661m last year to $1.8bn for the first nine months of 2014.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Clearly, whether AbbVie-Shire happens or not, 2014 is already set to be the most valuable year for M&A deals in recent times; the $192bn of transactions over the first nine months ($139bn excluding AbbVie-Shire) is already way above the pre-crash year of 2006, which amassed $100.7bn of takeover activity.

And away from the large deal limelight, smaller transactions are likely to continue to keep deal bankers occupied, as shown by the strategic therapy area rationale of moves like Roche on Seragon and Johnson & Johnson on Alios, continuing speciality pharma consolidation like Meda buying Rottapharm, or rumored defensive plays like Allergan/Salix.

|

|||||||||||||||||||||||||||

Rather, the question is whether what is now seen as an inevitable clampdown on tax inversion eliminates the rationale behind further big, premium-priced takeovers beyond that of Shire.

One potential tax-driven deal that has had the markets particularly excited is the return of Pfizer to the bidding table for AstraZeneca. It speaks volumes that today, in the wake of AbbVie's communication to Shire, Astra stock was off 2%.

Pharma and biotech M&A is not about to stop, but we might just have seen the beginning of the end of the deal-making bonanza.

Jacob Plieth/Joanne Fagg

EP Vantage