While the focus of the 2015 Small-Cap Biotech Watchlist panel was on names that made the cut, the five analysts also highlighted factors playing into the vigor of the space that investors should be on the lookout for, including the need for ongoing scientific innovation and changes in the pricing and regulatory environments. The panelists asked to select the 2015 Small-Cap Biotech Watchlist were George Zavoico of MLV & Co., Joe Pantginis of ROTH Capital Partners, Bert Hazlett of Ladenburg Thalmann & Co., Reni Benjamin of H.C. Wainwright & Co., and moderator Mara Goldstein of Cantor Fitzgerald.

1. Signs the Biotech Market Will Continue to Grow

Overall, the biotech market looks like it will remain robust for the foreseeable future, according to Benjamin. This should last until "some sort of sea change, whether it's macro, pricing pressure, or something else that causes generalists to come out of the sector. But there are several factors that should power this market for at least the next several years."

"The funding cycle over the last couple of years has left many small-cap companies in a much, much better financial position than they ever have been in."—Reni Benjamin

First up, according to Benjamin: a scarcity of innovation in big pharma. "Pharma companies continue to jettison their research and development (R&D) divisions left and right," he said, and instead look to biotechs for innovations that will power future growth. "The funding cycle over the last couple of years has left many small-cap companies in a much, much better financial position than they ever have been in. That's very good from a development point of view, because a lot of the small-cap companies we cover are running the right-size trials. . .Small-cap biotechs are running randomized Phase 2 studies that allow us to make much more educated and confident bets on products going forward."

Benjamin also pointed to M&A. "If pharma doesn't have an R&D division, it has to acquire or merge with other companies. . .there is really a significant push to acquire assets in development. Biotech is the only game in town for these bigger players that don't have R&D divisions."

Watch the 2015 Small-Cap Biotech Watchlist Panel Discussion

Then, there is pricing. "Pricing so far has not been an issue," Benjamin said. But "It definitely could derail the train at one point. It's something that all investors should keep an eye on because once that sort of shot is fired across the bow, you may see—and this might be an interesting point for us to discuss—something like what happened back in the 2000 genomic bubble. . .The second some sort of significant clampdown occurs, let's say, at the government level or the insurance level, that's going to cause a lot of investors to take some pause, because right now, the sky is the limit."

2. Is the Price Right?

The subject of pricing sparked comment from other analysts on the panel as well.

When a company has "an opportunity to position a novel drug in an otherwise commoditized environment, it can take price on it," Goldstein observed. And "for products that are truly novel, that's where we think you will tend to see the premium pricing be maintained."

But pharmacoeconomics—determining whether the price of the drug is worth the social and economic benefit—will be the deciding factor. Benjamin noted that currently, a gene therapy in Europe sells for $1.4M, and that remains acceptable.

"For products that are truly novel, we think you will tend to see premium pricing maintained."—Mara Goldstein

"Everybody is looking at what the United Kingdom is doing," said Zavoico. "The National Institute for Health and Care Excellence (NICE) doesn't add drugs to its formulary when it thinks the clinical and societal benefit is not sufficient to justify the cost to the healthcare system." He doesn't think that kind of action will happen in the States, but advised investors to bear in mind that some variation on the European model could take hold here, adding that the political climate for major policy change just isn't there, but that third-party payers may act on their own to rein in costs.

"There's a coming problem in oncology," observed Pantginis, recounting how the topic of pricing came up at a major cancer conference in 2014. Expensive targeted drugs—and combinations of expensive targeted drugs—are being used more often in lieu of traditional chemotherapies. "Right now, the blanket statement is if you garner a survival benefit, you're going to get reimbursed," he said. Then he noted that a doctor from MD Anderson told a panel at the conference that "the rising drug costs violate the Hippocratic oath of not causing harm to your patients."

3. Get a Grip on Risk/Reward

The analysts also took on the issue of how and when companies should abandon drug candidates.

"I'm a big believer that if a drug fails the primary endpoint, the trial has failed," said Benjamin. "A lot of biotech companies love to talk about going to the FDA with positive secondary endpoints—that the FDA is much friendlier right now." But this is not necessarily true, and "from a valuation perspective, it's easy for us to just take that revenue line right out of the model. The next step is to look at the rest of the pipeline. A lot of these companies are not one-trick ponies. They have a pipeline. They have other assets that could generate value."

"Small-cap biotechs are running randomized Phase 2 studies that allow us to make much more educated and confident bets on products going forward"—Reni Benjamin

"We do have companies that have very binary endpoints," Goldstein said. "Those have a very different risk/reward profile. You have to go in with eyes wide open and understand that irrespective of what you think of the data, it's a very long road to redemption once a trial has failed for a company. I look at the universe in two different ways: stocks that have binary endpoints but offsets. . .and then those that exclusively fit this binary endpoint model."

"Let's face it, every compound that's being developed is a billion-dollar compound, right?" Benjamin added. "If you're not developing a billion-dollar compound, you're not a biotech company. But if you're in Phase 1 and you have a $1B market potential, there's no investor on God's green earth who's going to value your company anywhere near that market potential. It's all risk-adjusted. That's something that we would definitely do after a Phase 3 failure."

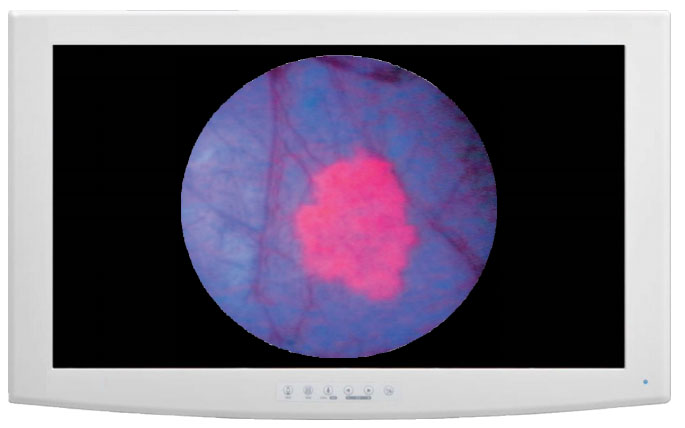

4. Consider Select Immunotherapy Companies for Future Growth

With all the focus on immuno-oncology, the analysts were optimistic about the prospects for sustainable valuations among companies working in this field. As Goldstein observed, "We have seen this subsector of oncology gyrate through various levels of investor enthusiasm, from wildly interested to unapologetically uninterested. Many will point to Dendreon Corp.'s (DNDN:NASDAQ) Provenge (sipuleucel-T) as a reason to believe that the overall commercial opportunity is limited. But we think that the argument is product-specific, rather than all encompassing."

"It really first comes down to, again, clinical data," said Pantginis. "In the vaccine space, we need another win, because it's been sullied by what happened with Dendreon. Investors and others throw these things into the same basket, even though different companies have different approaches with regard to immunotherapy. We need another Phase 3 win. We need another approval. Celldex Therapeutics Inc. (CLDX:NASDAQ) had some very good data with rindopepimut in recurrent glioblastoma. That could potentially be the next cancer vaccine win in the U.S., but it's really going to come down to the clinical data."

"Valuations for these small molecule checkpoint inhibitors are pretty solid," said Benjamin. "You have compelling data, you have approved products and you have big pharma licensing with small-cap biotechs. . .those are sustainable activities that are planting a foundational valuation on this entire class. We're hopeful that it's only up from here."

Read the 2015 Biotech Watchlist Story

2015 Small-Cap Biotech Watchlist Portfolio Tracker

The Approval Process in Action Infographic

Dr. Reni Benjamin is a managing director and equity research analyst at H.C. Wainwright & Co. His expertise and coverage focuses on companies in the oncology and stem cell sectors. Benjamin has been ranked among the top analysts for recommendation performance and earnings accuracy by StarMine, has been cited in a variety of sources including The Wall Street Journal, Bloomberg Businessweek, Financial Times and Smart Money, and has made appearances on Bloomberg television/radio and CNBC. He authored a chapter in "The Delivery of Regenerative Medicines and Their Impact on Healthcare," has presented at various regional and international conferences, and has been published in peer-reviewed journals. He currently serves on the UAB School of Health Professions' Deans Advisory Board. Prior to joining H.C. Wainwright, Benjamin was a managing director and senior biotechnology analyst at both Burrill Securities and Rodman & Renshaw. He was also an associate analyst at Needham and Company. Benjamin earned his doctorate from the University of Alabama at Birmingham in biochemistry and molecular genetics by discovering and characterizing a novel gene implicated in germ cell development. He earned a bachelor's degree in biology from Allegheny College.

Dr. Reni Benjamin is a managing director and equity research analyst at H.C. Wainwright & Co. His expertise and coverage focuses on companies in the oncology and stem cell sectors. Benjamin has been ranked among the top analysts for recommendation performance and earnings accuracy by StarMine, has been cited in a variety of sources including The Wall Street Journal, Bloomberg Businessweek, Financial Times and Smart Money, and has made appearances on Bloomberg television/radio and CNBC. He authored a chapter in "The Delivery of Regenerative Medicines and Their Impact on Healthcare," has presented at various regional and international conferences, and has been published in peer-reviewed journals. He currently serves on the UAB School of Health Professions' Deans Advisory Board. Prior to joining H.C. Wainwright, Benjamin was a managing director and senior biotechnology analyst at both Burrill Securities and Rodman & Renshaw. He was also an associate analyst at Needham and Company. Benjamin earned his doctorate from the University of Alabama at Birmingham in biochemistry and molecular genetics by discovering and characterizing a novel gene implicated in germ cell development. He earned a bachelor's degree in biology from Allegheny College.

Mara Goldstein joined Cantor Fitzgerald & Co. from Thomson Reuters, where she served as director of research for Reuters Insight. Goldstein was initially responsible for the firm's healthcare research practice, and later assumed responsibility for all research activities and sectors. Prior to that, Goldstein was an executive director and senior pharmaceutical analyst at CIBC World Markets. At Cantor, Goldstein covers the biotechnology sector. Goldstein also worked at Alex Brown & Sons and CS First Boston. She holds a bachelor's degree in economics from Purdue University.

Mara Goldstein joined Cantor Fitzgerald & Co. from Thomson Reuters, where she served as director of research for Reuters Insight. Goldstein was initially responsible for the firm's healthcare research practice, and later assumed responsibility for all research activities and sectors. Prior to that, Goldstein was an executive director and senior pharmaceutical analyst at CIBC World Markets. At Cantor, Goldstein covers the biotechnology sector. Goldstein also worked at Alex Brown & Sons and CS First Boston. She holds a bachelor's degree in economics from Purdue University.

Joseph Pantginis, Ph.D., joined ROTH Capital Partners in 2009. Prior to joining ROTH, Pantginis was a senior biotech analyst at Merriman Curhan Ford (now Merriman Holdings Inc.). Pantginis was also a senior biotechnology analyst at Canaccord Adams, focusing on the oncology, inflammation and infectious disease spaces. Prior to Canaccord Adams he was a biotech analyst at several firms, including JbHanauer & Co., First Albany Corp., Commerce Capital Markets Inc. and Ladenburg Thalmann & Co. Inc. Prior to his tenure on Wall Street, Pantginis served as an associate manager/scientist of Regeneron Pharmaceuticals' Retrovirus Core Facility. Pantginis received a master's degree in business administration (finance) from Pace University; a doctorate in molecular genetics and a master's degree from Albert Einstein College of Medicine; and a bachelor's degree from Fordham University.

Joseph Pantginis, Ph.D., joined ROTH Capital Partners in 2009. Prior to joining ROTH, Pantginis was a senior biotech analyst at Merriman Curhan Ford (now Merriman Holdings Inc.). Pantginis was also a senior biotechnology analyst at Canaccord Adams, focusing on the oncology, inflammation and infectious disease spaces. Prior to Canaccord Adams he was a biotech analyst at several firms, including JbHanauer & Co., First Albany Corp., Commerce Capital Markets Inc. and Ladenburg Thalmann & Co. Inc. Prior to his tenure on Wall Street, Pantginis served as an associate manager/scientist of Regeneron Pharmaceuticals' Retrovirus Core Facility. Pantginis received a master's degree in business administration (finance) from Pace University; a doctorate in molecular genetics and a master's degree from Albert Einstein College of Medicine; and a bachelor's degree from Fordham University.

Dr. George Zavoico, managing director and senior equity analyst at MLV & Co., has more than 10 years of experience as a life sciences equity analyst writing research on publicly traded equities. His principal focus is on biotechnology, biopharmaceutical, specialty pharmaceutical, and molecular diagnostics companies. He received The Financial Times/Starmine Award two years in a row for being among the top-ranked earnings estimators in the biotechnology sector. Previously, Zavoico was an equity research analyst in the healthcare sector at Westport Capital Markets and Cantor Fitzgerald. Prior to working as an analyst, Zavoico established his own consulting company serving the biotech and pharmaceutical industries, providing competitive intelligence and marketing research, due diligence services and guidance in regulatory affairs. Zavoico began his career as a senior research scientist at Bristol-Myers Squibb Co., moving on to management positions at Alexion Pharmaceuticals Inc. and T Cell Sciences Inc. (now Celldex Therapeutics Inc.). Zavoico has a bachelor's degree in biology from St. Lawrence University and a Ph.D. in physiology from the University of Virginia. He held post-doctoral fellowships at the University of Connecticut School of Medicine and Harvard Medical School/Brigham & Women's Hospital. He has published more than 30 papers in peer-reviewed journals and has coauthored four book chapters.

Dr. George Zavoico, managing director and senior equity analyst at MLV & Co., has more than 10 years of experience as a life sciences equity analyst writing research on publicly traded equities. His principal focus is on biotechnology, biopharmaceutical, specialty pharmaceutical, and molecular diagnostics companies. He received The Financial Times/Starmine Award two years in a row for being among the top-ranked earnings estimators in the biotechnology sector. Previously, Zavoico was an equity research analyst in the healthcare sector at Westport Capital Markets and Cantor Fitzgerald. Prior to working as an analyst, Zavoico established his own consulting company serving the biotech and pharmaceutical industries, providing competitive intelligence and marketing research, due diligence services and guidance in regulatory affairs. Zavoico began his career as a senior research scientist at Bristol-Myers Squibb Co., moving on to management positions at Alexion Pharmaceuticals Inc. and T Cell Sciences Inc. (now Celldex Therapeutics Inc.). Zavoico has a bachelor's degree in biology from St. Lawrence University and a Ph.D. in physiology from the University of Virginia. He held post-doctoral fellowships at the University of Connecticut School of Medicine and Harvard Medical School/Brigham & Women's Hospital. He has published more than 30 papers in peer-reviewed journals and has coauthored four book chapters.

Want to read more Life Sciences Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

DISCLOSURE:

1) Tracy Salcedo-Chourré prepared this article for Streetwise Reports LLC, publisher of The Gold Report, The Energy Report, The Life Sciences Report and The Mining Report, and provides services to Streetwise Reports as an employee. She owns, or her family owns, shares of the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are sponsors of Streetwise Reports: None. The companies mentioned in this interview were not involved in any aspect of the interview preparation or post-interview editing so the expert could speak independently about the sector. Streetwise Reports does not accept stock in exchange for its services.

3) Reni Benjamin: I own, or my family owns, shares of the following companies mentioned in this interview: None. I personally am, or my family is, paid by the following companies mentioned in this interview: None. My company has a financial relationship with the following companies mentioned in this interview: None. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I determined and had final say over which companies would be included in the interview based on my research, understanding of the sector and interview theme. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

4) Mara Goldstein: For important disclosures on companies mentioned, please go to www.cantor.com/futuresdisclosures.

5) Joseph Pantginis: I own, or my family owns, shares of the following companies mentioned in this interview: None. I personally am, or my family is, paid by the following companies mentioned in this interview: None. My company has a financial relationship with the following companies mentioned in this interview: None. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I determined and had final say over which companies would be included in the interview based on my research, understanding of the sector and interview theme. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

6) George Zavoico: I own, or my family owns, shares of the following companies mentioned in this interview: None. I personally am, or my family is, paid by the following companies mentioned in this interview: None. My company has a financial relationship with the following companies mentioned in this interview: None. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I determined and had final say over which companies would be included in the interview based on my research, understanding of the sector and interview theme. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

7) Interviews are edited for clarity. Streetwise Reports does not make editorial comments or change experts' statements without their consent.

8) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer.

9) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.