Revive Therapeutics Ltd. (RVV:TSX.V $0.16, OTCQB: RVVTF)

www.revivethera.com

Shares Outstanding: Approx. 55 million

Market Cap: $9 million

Working Capital: Approx. $2 million

The graphics used below were taken from Revive's August corporate presentation. You can find that document here.

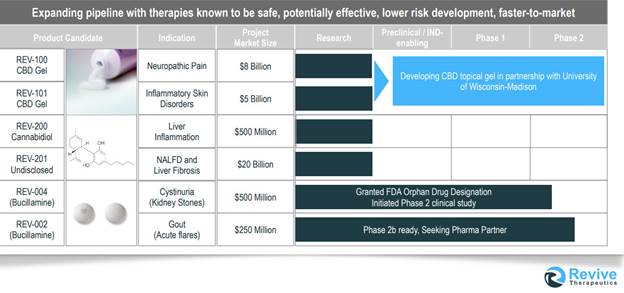

This snapshot provides an overview of Revive's business model. The company has several irons in the fire—but at the same time, is doing a very good job controlling its burn rate (a pitfall many life science companies fall into).

In addition to large markets for liver disease, gout, and kidney stones, Revive offers low risk exposure to a sector that has done very well this past year for several companies—cannabis sciences (health applications using the cannabis/marijuana plant). This is an aspect of life sciences that has limited public company competition so Revive offers an attractive way to gain investment exposure.

Revive for the most part is unknown in the cannabis science investment community. But others that have been properly promoted, like Tetra Bio-Pharma (TBP: CSE $0.62), command a market cap of $75 million with little cash and no revenue. This is eight times higher than RVV.

Others that were grossly promoted in the United States hit huge unrealistic valuations in Q1/17. OWCP on the OTCQB is just one such example of a company that was valued at more than US$400 Million—but now trades at 1/10th that—which is surprisingly, still seven times higher than Revive—yet the Revive business model is just as promising (if not more) than OWCP.

GW Pharma (GWPH $108) on NASDAQ brought to light (in the marijuana sector) the valuation potential of the "cannabis sciences." But the trick has been finding public companies that are "legitimate" and have the scientific expertise behind them.

GWPH has a market cap near US$3 billion. This company has minimal revenue but a pipeline of potential drugs derived from cannabis (CBD and THC)—primary focus is MS and Epilepsy. They came to fame in the UK when its market cap hit $1 billion, but after listing on NASDAQ, its valuation rose dramatically.

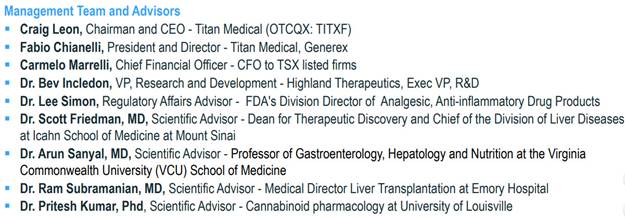

Revive has a VERY strong science/medical team as evidenced by the doctors noted below:

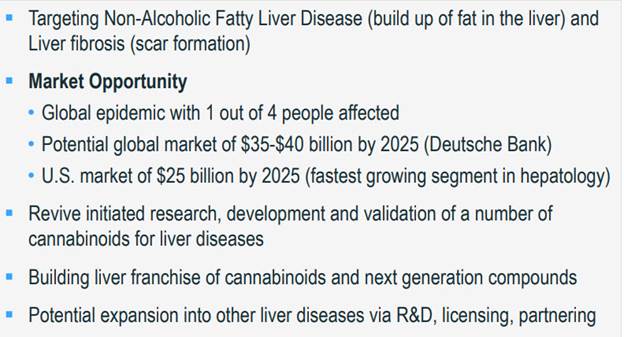

The cannabis sciences help provide some "sex appeal" but Revive also has "more traditional" drugs in its research and development pipeline. A primary focus is on liver disease:

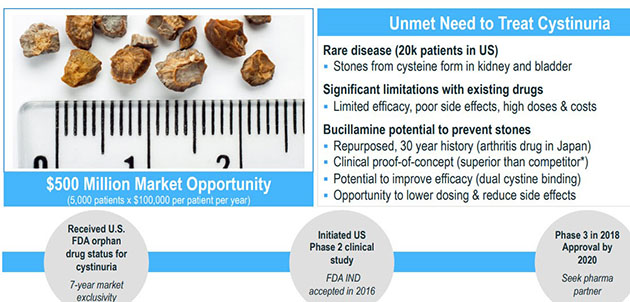

In addition to liver disease:

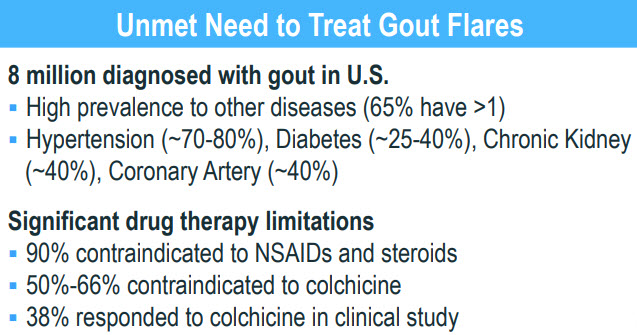

And gout:

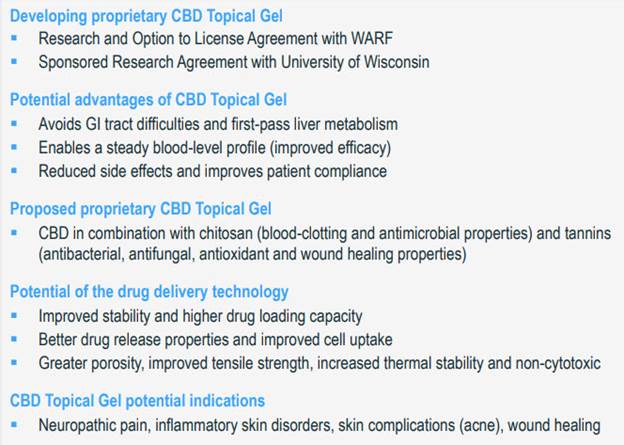

Unique (Cannabinoid—CBD) Drug Delivery Research/Partnership

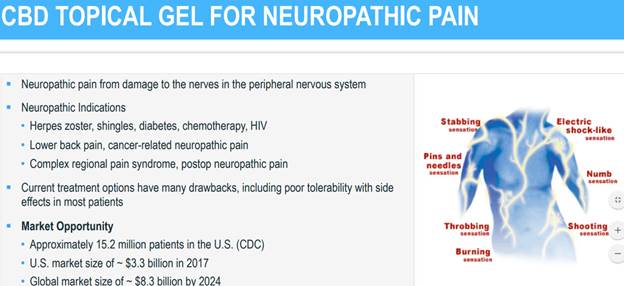

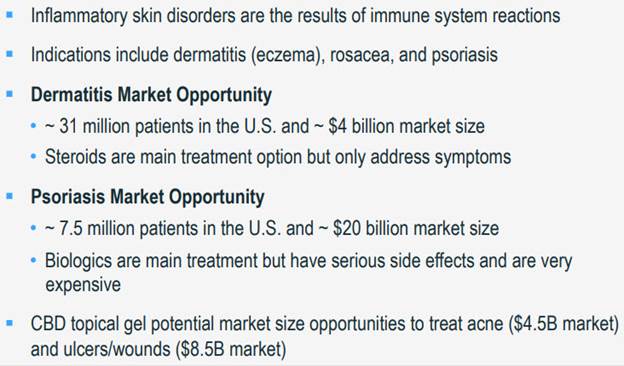

Revive has a sponsored research agreement with the University of Wisconsin (Madison) to evaluate a novel drug delivery technology with a focus on cannabinoids for the potential to treat various diseases (initial focus will be liver disease, pain and inflammatory skin disorders).

Dr. Jess D. Reed, PhD, and his research team will evaluate the role and potential use of a chitosan-tannin-based formula for the delivery of cannabinoids. The research will be based on Dr. Reed's patented technology in the use of tannin-chitosan composites for therapeutic biomaterials.

Research on the interaction between tannins and chitosan has led to the discovery of a new composite material that has anti-microbial activity and can be formed into films, foams, hydrogels and nanoparticles that have applications in food, agriculture and health. Chitosan is a derivative of chitin, which is present in the shells of shrimp, crabs, insects and other arthropods. Chitin is the second-most abundant biopolymer on the Earth's surface after cellulose.

This is new drug delivery technology for cannabinoids if successful, would be a groundbreaking process.

There are only a few public companies with notable research programs for topical CBD applications (gels, creams, foams)—or advancements in drug delivery (oral strips, dermal patches, or nasal sprays).

The market alone for topical gels is enormous (tens of billions annually) and if Revive and the University are successful with a unique CBD application, the valuation of RVV would change dramatically—never mind the other life science products in their pipeline.

Google, as we know, will find anything on the Internet—including press releases, patents, documents in public libraries or Universities. Other than the University of Wisconsin, I could find no research filed using the combination of Chitosan-Tannins. This is extremely important as it clearly demonstrates that this is "groundbreaking" research.

www.google.com/patents/US8642088—a large but very detailed document.

If proven successful, this research could become extremely valuable—FAR more valuable than the $9 million valuation we currently have with Revive—and right now, few investors know this company exists, which is why I believe there is a significant opportunity with RVV below 20 cents. A person just needs patience.

Important Note Concerning the University Research:

The University of Wisconsin and this research group are one of the few approved in the United States by both the DEA & FDA. They have already identified an FDA approved supplier of synthetic CBD and received supply from AMRI (www.amriglobal.com). They have started work on optimizing the formulation that should enable them to complete the first milestone (permeability).

Danny Deadlock is the founder and publisher of Microcap.com. He has over 30 years of experience with Canadian microcap companies listed on the TSX and TSX Venture Exchange.

Want to read more Life Sciences Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) I, or members of my immediate household or family, own shares of the following companies mentioned in this article: I own 200,000 shares of Revive purchased on the open market. I personally am NOT or members of my immediate household or family are NOT, paid by any companies mentioned in this article. My company (or anyone I am affiliated with) has NO financial relationship with ANY companies mentioned in this article. Danny Deadlock or anyone associated with him does NOT accept compensation in ANY form for featuring companies in MicroCap.com or Streetwise Reports. I determined which companies would be included in this article based on my research and understanding of the sector. Danny Deadlock is not a registered or licensed investment advisor and the information presented here is for educational purposes only.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: None. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Charts and graphics provided by the author.