In a June 8 press release, Inovio Pharmaceuticals Inc. (INO:NASDAQ) announced it "has commenced its phase 3 clinical program to evaluate the efficacy of [its] DNA-based immunotherapy, VGX-3100, to treat cervical dysplasia caused by human papillomavirus (HPV)." The company plans to "immediately begin recruiting patients for the phase 3 trial."

The REVEAL trial "will consist of a primary study (REVEAL 1) and confirmatory study (REVEAL 2), as per FDA general guidance for phase 3 programs, to be conducted in parallel," the release stated. "The studies will each enroll 198 patients in more than 100 study centers globally."

In a June 8 research report, Maxim Group analyst Jason McCarthy explained, "the clinical hold was related to the FDA requesting more information for the CELLECTRA 5PSP electroporation delivery device. Inovio has satisfied all requests and the clinical hold [was] lifted."

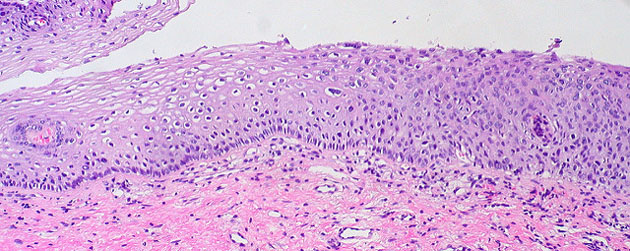

McCarthy noted that in Phase 2, "treatment with VGX-3100 resulted in histopathological regression of CIN2/3 to CIN1 or no disease" in patients with cervical dysplasia. He went on to state that, "While Inovio has continued to advance multiple earlier-stage DNA-based immunotherapies forward, providing incremental catalysts for the stock, our focus has remained on the start of the P3 program for VGX-3100 in high-grade cervical dysplasia. We see the VGX-3100 as the key driver of Inovio. With the clinical hold now lifted, Inovio has transformed into a pivotal company."

Maxim rates Inovio a Buy and has a $12 per share price target. Inovio shares are currently trading at around $8.11.

Raghuram Selvaraju of H.C. Wainwright & Co., in a June 8 research report, wrote, "In our view, the robust data of concomitant regression and viral clearance observed in the Phase 2b trial bode well for the outcome of the REVEAL studies." H.C. Wainwright has a Buy rating and a $13 per share price target on Inovio.

In a June 8 research report, PiperJaffray's Charles Duncan wrote, "Based on today's announcement of the Phase III start and design, we see incremental clinical and regulatory risk reduction for the '3100 program in cervical dysplasia. . .In addition, on today's news we see risk reduction for the platform more broadly in terms of later-stage clinical and regulatory execution." PiperJaffray rated the company Overweight and moved its price target up to $14 per share from $9 per share.

"Initiating our REVEAL phase 3 program marks a milestone for Inovio, for the next generation of DNA-based immunotherapies, and for women's health," Dr. Joseph Kim, Inovio's CEO and president, stated in the release.

In other news, on June 7 Inovio announced that in a preclinical study, its Zika vaccine candidate, GLS-5700, demonstrated it could protect against "Zika virus-induced damage to testes and sperm, and prevented persistence of the virus in the reproductive tract of all vaccinated male mice challenged with a high dose of the Zika virus."

"The fact that GLS-5700 can prevent Zika virus persistence in the reproductive tract in a preclinical setting suggests that this DNA-based vaccine has the potential to reduce Zika virus infection of human male reproductive tract and the risk of sexual transmission to a female," Selvaraju wrote in his report. Zika infection of pregnant mothers has been shown to result in birth defects.

On June 1, Inovio announced a "clinical collaboration with Genentech, a member of the Roche Group (RHHBY:OTCQX), for advanced bladder cancer. The phase 1b/2 immuno-oncology trial will evaluate Genentech's atezolizumab (TECENTRIQ) in combination with Inovio's INO-5401, a T cell activating immunotherapy encoding multiple antigens, and INO-9012, an immune activator encoding IL-12." The press release explained that "The multi-center open-label trial will be managed by Inovio, and Genentech will supply atezolizumab. It is anticipated to start in 2017 and designed to evaluate the safety, immune response and clinical efficacy of the combination therapy in approximately 80 patients with advanced bladder cancer."

The company expects to initiate five clinical trials with efficacy endpoints in 2017. These include the Phase 3 cervical dysplasia study, a Phase 2 trial of VGX-3100 in HPV-related vulvar neoplasia, and several immuno-oncology programs of combination therapies coupling Inovio compounds with checkpoint inhibitors. Collaborators in the combination studies include MedImmune/AstraZeneca Plc (AZN:NYSE; AZN:LON), Genentech/Roche, and Regeneron Pharmaceuticals Inc. (REGN:NASDAQ), the last targeting newly diagnosed glioblastoma multiforme, a deadly brain cancer.

Inovio also plans to report data in 2017 on its prostate cancer and hepatitis B immunotherapies, as well as publish data on its vaccines targeting Zika, Ebola and MERS viruses.

Read what other experts are saying about:

Want to read more Life Sciences Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Tracy Salcedo compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. She or members of her household own shares of the following companies mentioned in this article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned are sponsors of Streetwise Reports: Inovio Pharmaceuticals Inc. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Additional disclosures about the sources cited in this article