Vancouver-based blockchain company Global Compliance Applications Corp. (APP:CSE; FUAPF:OTCQB; 2FA:FSA) has signed an agreement with a South African insurance company to join that country’s expanding cannabis industry.

GCAC has entered into a sale of shares agreement where it will acquire 33% of a special purpose vehicle (SPV) with Blue Anchor Risk Solutions (Pty) Ltd. called Blue Anchor 420 SPV (Pty) Ltd.

The global cannabis market is expected to grow from US$25 billion in 2021 to US$150 billion by 2031, a compound annual growth rate of 20.5% between 2022 and 2031, JC Market Research said in a report released this week.

The South African government estimates the cannabis industry to be worth an estimated 28 billion rand (South African currency) that could create between 10,000 and 25,000 jobs.

The South African government estimates the cannabis industry to be worth an estimated 28 billion rand (South African currency) that could create between 10,000 and 25,000 jobs.

A 2018 court ruling decriminalized the private use, possession, and growing of cannabis there, and President Cyril Ramaphosa earlier this year said the country should tap into the industry.

“With the government policies changing, the demand for medical marijuana is also rising,” Grand View Research said in a report. “A lot of countries that have legalized the use of medical marijuana are also paving the way for its cultivation to cut on the imports and gain revenue in the form of taxes. This, in turn, has generated jobs in the industry, and a lot more companies are dabbling in this territory.”

Blue Anchor 420 is the only specialist cannabis underwriter in Southern Africa, according to GCAC.

GCAC’s Efixii app and blockchain allow farmers to get feedback from buyers and offer them digital rewards in exchange.

The company has also signed an exclusive reseller agreement with Efixii Africa, a wholly-owned subsidiary of Blue Anchor 420 SPV. GCAC will be paid a fee of US$230,000 by Efixii Africa to license its software to local cannabis cultivators.

For the 33% interest in the SPV, GCAC will pay Blue Anchor CA$200,000 in shares at CA$0.05 per share. Those payment shares will be subject to a four-month hold period after the transaction is completed.

The Catalyst

Medical marijuana is now legal in 38 U.S. states and the District of Columbia, and cannabis is legal for all adults in 21 states and DC.

Studies show that medical marijuana can be used to treat symptoms of chronic pain, chemotherapy-induced nausea, Parkinson’s, Alzheimer’s, and other neurological diseases.

GCAC’s Efixii app enables growers to have direct relationships with end consumers, as well as verify the purity of their products. Via a QR code, the grower can provide stories about their products that are available to anyone with the app and a smartphone — where it was grown, its genetic makeup, and feedback from other consumers. The consumer can share feedback of their own and get rewards from the grower, like non-fungible tokens (NFTs).

GCAC has also partnered with EMTRI Corp., a leading cannabis marketing and advisory agency that issues electronic money tokens (EMTs) to farmers on GCAC’s blockchain. EMTRI and GCAC last week announced they had launched EMT trading on Uniswap, giving liquidity to EMT holders.

The program will record these things along the way for South African growers, each step from genetics to planting, from harvesting to distribution.

“It’s a better way for them to sell their product to consumers,” GCAC Chief Executive Officer Brad Moore told Streetwise Reports.

Markets are opening as attitudes toward cannabis continue to shift. U.S. President Joe Biden recently pardoned thousands of people charged with simple marijuana possession on the federal level.

And another non-psychoactive substance in hemp, cannabidiol (CBD), is being used for skin care, anxiety, seizures, and pain management. The CBD market is expected to grow from US$2.42 billion in 2021 to US$15.66 billion by 2028, according to a report by The Insight Partners.

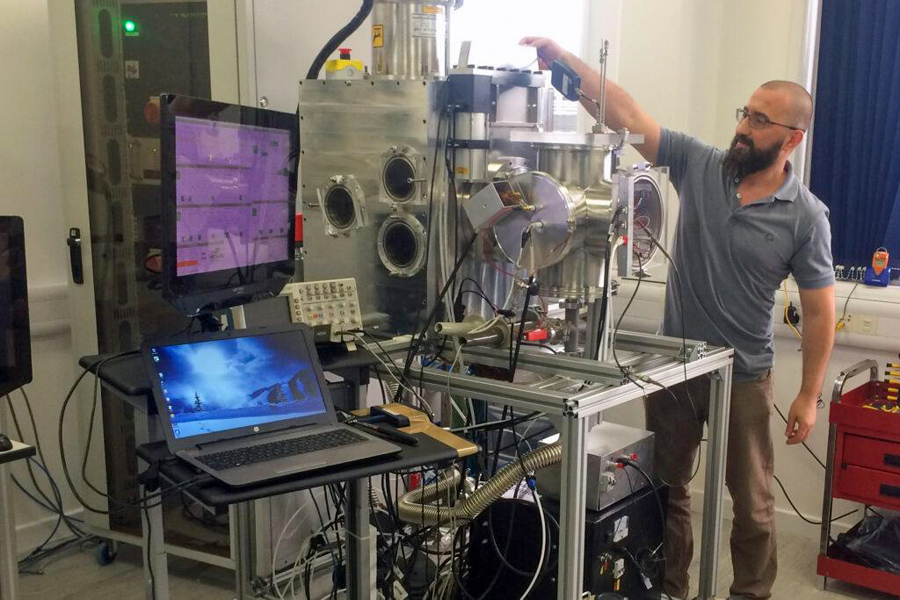

The Blockchain

The Ethereum blockchain that Efixii works on is an electronic distributed ledger system where no one entity, like a bank, has control. Blockchains are best known for their role in cryptocurrency systems, but they can be used for any database — such as agricultural records and customer interactions.

GCAC launched Efixii in 2020 with its own Layer 2 Ethereum blockchain. It has the ability to create NFTs.

Moore thinks many everyday electronic items will be consolidated into the blockchain eventually, like all your rewards programs for stores and the other physical cards you might have in your wallet or dangling from your keychain right now.

For growers and their customers, it will enable them to connect directly, even when there are other middlemen involved in the transactions.

GCAC has also partnered with EMTRI Corp., a leading cannabis marketing and advisory agency that issues electronic money tokens (EMTs) to farmers on GCAC’s blockchain. EMTRI and GCAC last week announced they had launched EMT trading on Uniswap, giving liquidity to EMT holders.

“They're the last to receive anything,” EMTRI Chief Executive Officer Eric Kennedy said of the farmers during a recent interview with Moore. “They're the first to put up everything. So, we really thank them . . . This is something that's brand new, it's never been done before. This is groundbreaking.”

Ownership and Share Structure

GCAC's top shareholders include Chief Financial Officer and Director Alexander Helmel with 2.57% or 5.29 million shares, CEO Moore with 2.54% or 5.25 million shares, Hanan Gelbendorf with 0.81% or 1.67 million shares, and Director Jeffrey Hayzlett with 0.08% or 0.16 million shares.

The company has a market cap of CA$ 5.01 million, with 206.2 million shares outstanding, 193.9 million of them free-floating. It trades in a 52-week range of CA$0.075 and CA$0.015.

| Want to be the first to know about interesting Cannabis, Technology and Cryptocurrency / Blockchain investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Disclosures:

1) Steve Sobek wrote this article for Streetwise Reports LLC. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with: Global Compliance Applications Corp. Please click here for more information.

3) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Global Compliance Applications Corp., a company mentioned in this article. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Global Compliance Applications Corp., a company mentioned in this article.