This weekend found me at a loss for manning the keyboards with my usual flair and literary gusto as the combination of spring weather and rangebound markets render high-conviction trade set-ups few and far between.

"My best shorts come from research reports where there are recommendations 'to buy stocks on weakness.'" — Mark Howard, Hedge Fund Manager

I sat down on Friday afternoon and reeled off three pages on gold and silver before finally realizing that I wrote essentially the same message last weekend when covering silver.

Then on Saturday, I decided to take off on a rant about the purity of the global lithium market before having to rethink everything after I learned that Latin American sovereign mining giant Chile had nationalized its lithium extraction industry. With some family business on Sunday morning, this leaves me only Sunday afternoon/evening to find a topic that is) relevant, b) interesting, or c) useful.

The best place for me to find "actionable ideas" is always in the chart book.

SPX

As I was beginning to get bothered by the "tape" late last week, I pulled out the book and took a glance at the SPX, which has been working a bullish MACD "buy" signal since mid-March, some 8.1% below where the SPX closed on Friday.

It is obvious from the MACD indicator the market is starting to run out of gas such that another couple of days of additional weakness could trigger a bearish MACD crossover sending stocks into a near-term cliff-dive and while not necessarily a major "sell signal," it would most certainly wreak havoc on holders of May calls.

If it turns out that the two convergence and divergence lines do not cross and, in fact, begin to widen out, then my concerns will be unfounded; if those two lines simply run parallel for a while, then the rally can extend itself, but for now, all we can do is watch and wait.

Gold-to-Silver Ratio

The Gold-to-Silver Ratio (the "GSR") used to trade low as 15 in the '60s and '70s but traded north of 100 during the 2008 GFC. Over the years, the near-term direction of this ratio has provided me with a terrific inverse indicator of the entire precious metals complex, in that no trustworthy advance in gold and silver or the miners can be sustained without a prolonged downtrend in the GSR.

Gold and silver remain very much in uptrends, with no better confirmation than the GSR trading under 80 and threatening to break down through 78.00, the uptrend line drawn off the 73.85 low back in December.

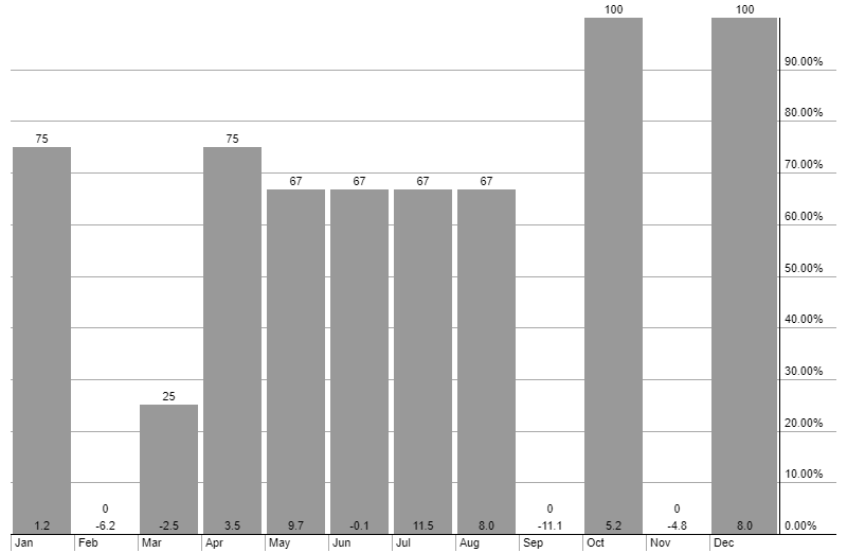

Also, from a seasonality perspective, last year, the next four months were all equal in seasonal strength, so given that silver has already weathered the storm of being the second-weakest month of the year, adding to the metals appears to be a solid move.

Lithium

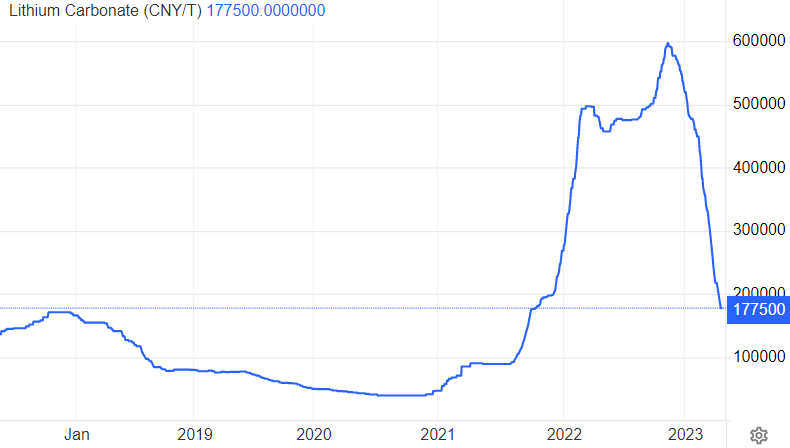

Last but not least, for our new "best friend" on the metals desk, Dr. Copper's trusted ally, Professor Lithium. I get bombarded with countless emails about the steep correction in lithium prices since the peak price was seen in November 2022.

"It's another bubble!" in reference to crypto and cannabis manias of the 2009 to 2022 period, but the problem with associating crypto and cannabis with Dr. Copper and Professor Lithium is this the latter two materials have enormous demand driving price versus crypto where demand is driven by a need to depart the "fiat world" and cannabis helping you to depart the world of consciousness, period, neither of which is necessarily bad but each of which can find unlimited substitution. Mind you, chances of being robbed at gunpoint for one's lithium stash are "light" at best.

NLINSERT]

Michael Ballanger Disclaimer:

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

Disclosures:

1) Michael J. Ballanger: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with: None. Please click here for more information.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.