Chen Lin may be starting to sound like a broken record after being bullish on silver for at least the last year, but you can pardon the asset manager if he feels a little vindicated by the precious metal's recent two-year high.

The current rally was from US$24.52 per ounce on March 28 to US$27.22 on the morning of April 4.

The author of the What is Chen Buying? What is Chen Selling? newsletter said he was excited to see the breakout and is suggesting two silver companies for his Q2 picks.

"I'm just so I'm so stressed out with all of this profit, I don't know where and when to take it," he joked.

Silver is the most conductive element in nature. In addition to being a precious metal, it's important to the green economy transition because it's used to coat electrical contacts in computers, phones, cars, and appliances. It's also an important element in solar technology.

In an update last year, the World Silver Institute said there was a deficit of 140 million ounces (Moz) between supply and demand for silver in 2023, compared to 237.7 Moz in 2022. However, the institute also noted that global output shrunk 2% in 2023.

"Mined output over the longer term, four to five years out, is forecast to begin to decline," the institute said in its World Silver Survey 2023. "This will be due to losses from grade decline and reserve depletion at existing operations exceeding the new production that is expected to come online from the current project pipeline."

But Chen said he was "extremely excited" about the metal's future.

"Silver should make a move, it's about time," Chen said. "The (World) Silver Institute will release their new market trend reports on April 17, and I expect another huge deficit for 2024. That should excite the market. I see silver hitting new highs."

Ron Struthers of Struthers Resource Stock Report, who typically follows gold, recently wrote that a breakout was "imminent" for silver.

"Silver is often referred to as poor man's gold because often it starts rising in price after gold," Struthers wrote. "Many investors, especially retail, will think gold has gone too high and is too costly, so (they) will buy silver."

"As they say, timing is everything, and I believe the time is soon arriving" for silver, Struthers noted.

Chen also recommended a gold company, a copper company, two energy companies, and a biotech.

Cerro de Pasco Resources Inc.

For his first silver company, Chen turned to a frequent pick, Cerro de Pasco Resources Inc. (CNSX:CDPR; OTCMKTS:GPPRF), which is developing the El Metalurgista mining concession in Peru and exploring the Quiulacocha Tailings Project at the site, as well as its wholly-owned Santander Mine.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Cerro de Pasco Resources Inc. (CNSX:CDPR; OTCMKTS:GPPRF)

The company is awaiting a rare easement for the project from the country and has signed a memorandum of understanding to collaborate with Volcan Compania Minera and received a loan from Glencore International Plc (GLNCY:OTCMKTS) to cover the costs of the first phase of the project. Volcan will allow Cerro de Pasco rights to process materials through its processing plants.

Cerro de Pasco last month noted it was paying a fee of about CA$1.35 million to the government in relation the easement, which was temporarily delayed in part by a change in Minister of Energy and Mines for the country but "is expected imminently."

Chen said he has kept a position in the company for five years waiting for the development. "Finally, it's about to happen," he said.

About 12% of the country is held by insiders and management, about 15% is held by institutions, and the rest is retail, according to Reuters.

Top shareholders include LH Financial Services Corp. with 15%, Gordaldo Ltd. with 8.96%, Executive Chairman Steven Zadka with 7.22%, Executive Director and Chief Executive Officer Guy Goulet with 2.71%, and President and Director Manuel Rodriguez with 1.15%.

Its market cap is CA$28.19 million, with about 348 million shares outstanding. It trades in a 52-week range of CA$0.16 and CA$0.06.

Hycroft Mining Holding Corp.

Next, the newcomer to Chen's silver stable is Hycroft Mining Holding Corp. (HYMC:NASDAQ), a U.S.-based gold and silver company exploring and developing the Hycroft Mine, one of the world's largest precious metals deposits located in northern Nevada.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Hycroft Mining Holding Corp. (HYMC:NASDAQ)

After a long history of oxide heap leaching operations, the company is focused on completing the technical studies to transition the Hycroft Mine into a large-scale milling operation for processing the sulfide ore, the company said.

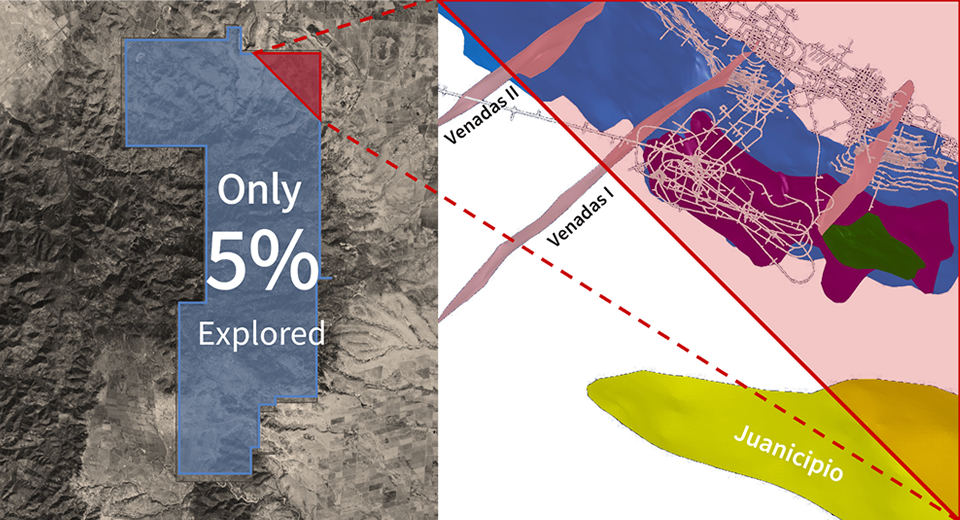

In addition, Hyrcroft said it is engaged in a drilling campaign to unlock the full potential of its more than 64,000-acre land package, of which less than 10% has been explored.

"They're rebuilding from the ground up," Chen said, noting the stock is "still way, way low" and a great opportunity.

Hycroft said recent drilling and analysis showed significant high-grade silver mineralization (more than 137 g/t Ag) that has continuity with historical drilling, along trends not previously identified.

"The purpose of the 2024 Drill Program is to define the structural framework of the new trends and target areas that have not been drilled to establish continuity of the high-grade silver trends," the company said in a release.

About 21% of Hycroft is owned by strategic entities, including mining financier Eric Sprott, who owns 9%. About 8% of the company is institutional, about 2% insiders and management, and the rest, 69%, is retail, according to the company.

Other major shareholders include The Vanguard Group Inc. with 3.46%, Susquehanna International Group with 0.83%, BlackRock Institutional Trust Company with 0.76%, and Geode Capital Management LLC with 0.69%, according to Reuters.

Hycroft has a market cap of US$72.26 million with about 21 million shares outstanding. It trades in a 52-week range of US$5.78 and US$1.63.

Western Exploration Inc.

For gold, Chen said he liked Western Exploration Inc. (WEX:TSX.V;WEXPF:OTC) for its "high-grade" Aura project in northeastern Nevada.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Western Exploration Inc. (WEX:TSX.V;WEXPF:OTC)

In its annual update to shareholders, the company noted that it made "significant strides" in 2023 toward goals of completing a preliminary feasibility study (PFS) at the Doby George deposit and increasing the size of the Wood Gulch/Gravel Creek resources at Aura.

Two holes drilled last year evaluated the resource expansion potential northeast of the Gravel Creek resource. Hole WG457 reported assays of up to 257 grams per tonne gold (g/t Au) and 1,655 g/t silver (Ag), including 0.7 meters of 143.56 g/t gold equivalent (Au Eq) and 1 meter of 67.49 g/t Au Eq. Hole WG456 reported 2,800 g/t Ag.

According to an updated mineral resource estimate (MRE), Gravel Creek has a resource of 245,571 Au Eq ounces at 5.81 g/t Au Eq in the Indicated category and 442,814 Au Eq ounces at 5.02 g/t AuEq in the Inferred category.

"They have everything lined up for them to do a major drilling this year," Chen said. "So, we should expect a lot of new drilling results this year, which should propel them to a much higher valuation."

Technical Analyst Clive Maund rated the stock a Strong Buy on April 2, who pointed out that a smaller portion available for retail investors could have big ramifications on the share price.

"Any significant increase in demand for the stock could drive a spectacular spike," Maund wrote.

According to Reuters, approximately 74% of the company is owned by strategic investors, including Goldonda LLC, which is a syndicate of dozens of high-net-worth investors and owns about 58% of the company. Agnico owns 16%.

Management and directors own around 7%, and other institutions own an estimated 12%. The rest is retail.

The company has a market cap of CA$38.93 million and has 34.45 million shares outstanding. It trades in a 52-week range of CA$2.20 and CA$0.46.

American Pacific Mining Corp.

For copper, Chen picked American Pacific Mining Corp. (USGD:CSE; USGDF:OTC), an explorer and developer with two flagship assets in the U.S.: the Palmer Project, a Volcanic Massive Sulfide-Sulphate (VMS) project in Alaska under joint-venture partnership with Dowa Metals & Mining, owner of Japan's largest zinc smelter; and the Madison Project, a past-producing copper-gold project in Montana.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

American Pacific Mining Corp. (USGD:CSE; USGDF:OTC)

The company intersected 6.54% copper (Cu) over 43.8 meters, including 9.03% Cu over 23.9 meters at Palmer, and plans to follow up with more drilling this year.

For the Madison transaction, American Pacific was selected as a finalist in both 2021 and 2022 for "Deal of the Year" at the S&P Global Platts Global Metals Awards for the Madison transaction.

Madison encompasses 2,514 acres of six patented lode claims and 108 unpatented mineral claims. Between 2008 and 2012, it produced 2.7 million pounds of copper with grades ranging from about 20% to more than 35% copper and 7,570 ounces of gold at 16.1 g/t.

"Recent interpretations identified multiple priority target areas believed to be associated with large-scale porphyry mineralization at depth and located within a well-mineralized, 2-mile-long geological, geophysical and geochemical trend," at the project, American Pacific said on its website. "The project is permitted for mining, surface and underground exploration."

The company said the mine is analogous to the Butte mine just 48 kilometers away, which produced 21 billion pounds of copper, 715 Moz Ag, and 2.9 Moz Au.

"This year should be very, very exciting year for them," Chen said of American Pacific. "They're going out financing right now. They should have a good runway."

According to the company, strategic junior mining strategic investor Michael Gentile owns about 12% of the company, and 15% is owned by institutions. The rest, 73%, is retail.

According to Reuters, some other major shareholders include Merk Investments LLC with 1.53%, Chief Executive Officer and Director Warwick Smith with 0.35%, Managing Director of Exploration and Director Eric Saderholm with 0.27%, and Palos Management Inc. with 0.18%.

The company has a market cap of CA$49.15 million with 196.59 million shares outstanding. It trades in a 52-week range of CA$0.43 and CA$0.17.

TAG Oil Ltd.

The first of Chen's two energy companies is TAG Oil Ltd. (TAO:TSX.V; TAOIF:OTCQX), which is developing the unconventional heavy oil Abu Roash F (ARF) formation in the Badr oil field (BED-1) of Egypt's Western Desert.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

TAG Oil Ltd. (TAO:TSX.V; TAOIF:OTCQX)

TAG's phase 1 development program for the ARF reservoir has already reestablished production at the site, and the new horizontal well is designed to increase it.

"That will unlock hundreds of millions of barrels of oil," Chen said. "And it's extremely economical. The payback, we're talking about months."

As Malcolm Shaw of Hydra Capital Partners explained in a March 15 Streewise article, "Oil and natural gas stocks remain cheap relative to other sectors."

"With the potential for 60-80+ locations in the company's Badr concession area, the company is poised for substantial growth in the coming years should its pending well test show commercial rates. Anything over 1,000 barrels of oil per day as an initial production rate should be viewed as a success. With flow test results expected in early April, TAG Oil represents a timely and interesting speculation," Shaw concludes. "It's worth noting that the Abu Roash F formation is an oil source rock that is analogous to the prolific Eagle Ford play in the southern United States."

Refinitiv provided a breakdown of the company's ownership and share structure where management and insiders own approximately 4.05% of the company.

According to Refinitiv, CEO Toby Robert Pierce owns 0.89% of the company, COO Suneel Gupta owns 1.71%, CFO Barry MacNeil owns 0.74%, and Director Gavin Hugh Lothian Wilson owns 0.62%.

Refinitiv reports that institutions own approximately 2.95% of the company, as Purpose Investments Inc. owns 1.73%, and Novum Asset Management A.G. owns 0.55%.

According to Refinitiv, there are 184.66 million shares outstanding and 122.15 million free float traded shares, while the company has a market cap of CA$89.78 million and trades in a 52-week range of CA$0.33 and CA$0.85.

New Stratus Energy Inc.

New Stratus Energy Inc. (NSE:TSX.V) was also one of Chen's picks at the start of 2024.

Reactivation of the pumps at the Venezuelan oil fields that New Stratus Energy Inc. holds a stake in are underway with the goal of producing about 3,500 barrels per day (bbl/d) by the end of the year.

The Lido-Limon and Oficina fields in Venezuela are assigned to the joint venture Petrolera Vencupet SA, of which GoldPillar International Fund SPC Ltd. holds a 40% stake. New Stratus announced in January it had acquired a 50% indirect interest in GoldPillar, giving it a 20% interest in the oil fields.

Gross production has been steadily rising from 116 bbl/d in January to 260 bbl/d by March 4, and the company predicts it will hit 1,000 bbl/d by the end of April. However, after closing at its highest point since 2022 at CA$0.84 on Dec. 27, 2023, the stock has stayed below CA$0.70 since the beginning of February.

Chen said he was surprised more investors haven't caught on to the company.

"I think this is just an untold story," the asset manager said. "We just need to be patient. There will be a lot more news coming in now."

In a February 26 research note, Echelon Capital Markets analyst Adam Gill noted that the possible reimposition of sanctions on Venezuela should have no effect on the work in the oil fields. He said NSE, which the firm gave a Buy rating and a CA$1.40 per share target price, has a "high-value level" after the Venezuela deal.

According to Reuters, about 2.4% of the company is owned by institutions, 10.8% by strategic entities, and 15.96% by management and insiders.

Top shareholders include the CEO Arata with 4.92%, Chief Geological Officer and Executive Director Marino Ostos with 4.13%, and U.S. Global Investors Inc. with 1.52%.

Its market cap is CA$81.25 million, with 125 million shares outstanding. It trades in a 52-week range of CA$0.84 and CA$0.21.

Rezolute Inc.

Chen's biotech pick is Rezolute Inc. (RZLT:NASDAQ), a clinical-stage biopharmaceutical company committed to developing new and transformative therapies for serious metabolic and rare diseases.

In March, the company announced results from a preclinical pharmacology study that it said validates the potential for its lead clinical compound, RZ358, to treat individuals with non-islet cell tumors (NICTs) that have uncontrolled hypoglycemia.

"We are excited by the potential for RZ358 to provide dramatic therapeutic benefit to cancer patients who often have limited treatment options for managing serious and uncontrolled hypoglycemia, which can accompany their cancer and disrupt treatment plans,” said the company's chief medical officer, Dr. Brian Roberts.

Rezolute said it successfully interacted with the U.S. Food and Drug Administration (FDA) in January "regarding the potential to initiate a single registrational study in patients with hypoglycemia due to tumor HI."

According to Reuters, Rezolute about 78% of the company is owned by institutions, and about 21% by strategic entities, including about 20% by corporations.

The top shareholders include Federated Hermes Global Investments with 25.63%, Handok Inc. with 15%, Vivo Capital LLC with 8.18%, Nantahala Capital Management LLC with 7.63%, and Stonepine Capital Management with 6.99%, Reuters said.

The company has a market cap of US$91.53 million with 39.63 million shares outstanding. It trades in a 52-week range of US$2.73 and US$0.72.

Sign up for our FREE newsletter

Important Disclosures:

- Western Exploration Inc. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000. In addition, Western Exploration Inc. has a consulting relationship with an affiliate of Streetwise Reports, and pays a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Western Exploration Inc. and New Stratus Energy Inc.

- Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.