Arch Biopartners Inc (ARCH:TSXV; ACHFF:OTCQB) is a therapeutic biotech company developing novel drugs for acute kidney injury (AKI) and chronic kidney disease (CKD).

The human kidneys filter about 200 liters of blood each day, removing two liters of toxins, wastes, and water in the process. They regulate fluid levels, release hormones to regulate blood pressure and produce red blood cells, and help maintain healthy bones. It's critical to do all that is possible to ensure these key organs are free from damage and disease.

The company is advancing an integrated program that includes new treatments targeting inflammation- and toxin-related kidney injury.

Arch's development pipeline includes:

- LSALT peptide: in a Phase II trial targeting cardiac surgery-associated AKI

- Cilastatin: a repurposed drug in a Phase II trial targeting toxin-induced AKI

- CKD Platform: next-generation therapeutics targeting chronic kidney disease

These assets represent distinct, mechanism-based approaches to treating and preventing common causes of kidney damage.

Together, they target serious unmet needs in kidney care across both chronic and acute indications, affecting more than 800 million people worldwide.

Both lead programs are currently enrolling patients at North American clinical sites.

The Team Leaders

A New Chairman Of The Board

Dr. Patrick Vink, M.D., M.B.A., has been an advisor to the pharmaceutical industry since 2015 and has served as a non-executive board member or chair of several public and private companies in North America and Europe.

He has overseen or supported several transactions in these roles, including Bruker Corporation's majority-ownership investment in Biognosys AG in 2023, and Chiesi Farmaceutici's acquisition of Amryt Pharma later the same year.

Dr. Vink previously served as Executive Vice President and Chief Operating Officer of Cubist Pharmaceuticals, Inc., overseeing global commercial and technical operations until its $9.5 billion acquisition by Merck in 2015.

Prior to Cubist, he was Senior Vice President, Global Head of Hospital Business and Biologics for Mylan Inc. (now Viatris Inc.).

Earlier in his career, he held senior roles at Novartis Sandoz, Biogen, and Sanofi-Synthelabo.

He served as a director of Arch Biopartners from December 2016 until December 2019, and continued to support the Company as a Strategic Advisor thereafter.

Investors can access management's discussion and analysis here.

Chief Science Officer

Dr. Daniel Muruve, MD, is a Professor in the Department of Medicine at the University of Calgary.

He graduated from the Faculty of Medicine at the University of Manitoba in 1989 and has undertaken extensive post-graduate medical and scientific training for over 10 years at the University of Calgary, Harvard University, and the University of Lausanne.

Dr. Muruve is a certified kidney specialist and a basic scientist with expertise in the biology of kidney disease and the molecular basis of inflammation and the immune system.

He is an AHFMR Clinical Senior Scholar and holds a Canada Research Chair in Inflammation and Kidney Disease.

The company's investor presentation is a must-read for prospective investors.

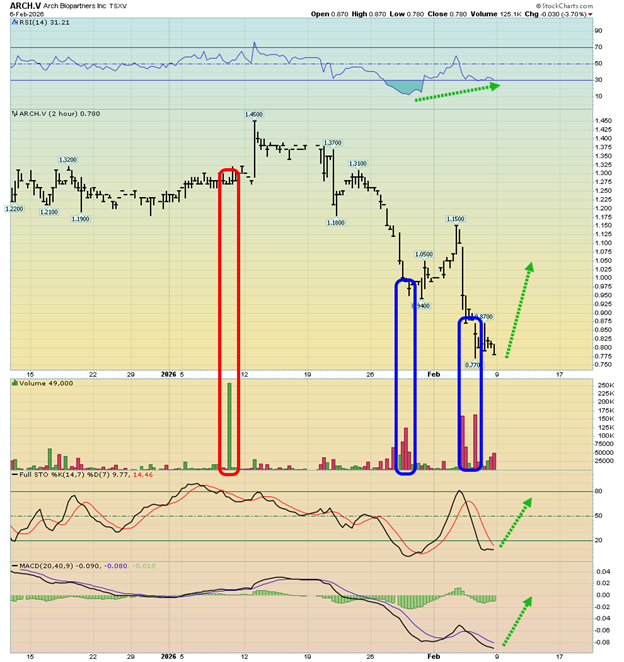

Technical Analysis

CA:ARCH.V Monthly Chart

Key Support: The stock is trading near the massive support zone of CA$0.75, which extends back to 2016… and has acted as a launchpad for significant rallies in the past.

The key RSI oscillator is almost oversold. That's positive. Stochastics is also at a point where a big move up in the oscillator and the price could occur.

Price Targets: The previous zones of resistance at CA$1.70 and CA$2.50 should be on investor radar screens as two key targets for the price.

A Double Bottom Pattern?

A potential double bottom pattern is in play for the stock.

While the CA$1.70 and CA$2.50 targets represent substantial capital appreciation, on a monthly close over CA$2.75, an even bigger rally to a target price of CA$4.25 would be indicated.

That's the de facto neckline zone of the pattern. Biotech investing can be speculative, because patent issues and clinical trial results can make or break a new treatment or drug…

But that's also what opens the door to significant investor reward if these items play out according to plan.

A Closer Look

On this two-hour bar chart, there's a significant bullish divergence between the RSI oscillator and the price.

Just as the early January spike in volume was an investor warning sign… the current surge in volume suggests strong hands are taking over from weak.

All in all, the short-term chart action reinforces the thesis that the CA:$0.75-$0.65 zone could be an exciting one for speculators to buy.

Stock price at time of writing: About CA$0.67

Technical Price Targets: CA$1.70, CA$2.50, and CA$4.25

Technical Rating: Speculative Buy

Arch Biopartners Inc. (ARCH:TSXV; ACHFF:OTCQB) closed for trading at CA$0.79, US$5787 on February 9, 2026.

| Want to be the first to know about interesting Biotechnology / Pharmaceuticals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

-

For this article, the Company has paid Street Smart, an affiliate of Streetwise Reports, US$3,500.

- As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of Arch Biopartners Inc.

- Author Certification and Compensation: Stewart Thomson was retained and compensated as an independent contractor by Street Smart for writing this article. Mr. Thomson is a retired Canadian financial advisor who has passed the Canadian Securities Course as well as additional technical analysis courses that were mandated by his former employer and approved by Ontario regulatory bodies. For the past 15 years, he has been editing and writing numerous financial newsletters that have a strong focus on charts. The recommendations and opinions expressed in this content reflect the personal, independent, and objective views of the author regarding any and all of the companies discussed. No part of the compensation received by the author was, is, or will be directly or indirectly tied to the specific recommendations or views expressed.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services, or securities of any company.

For additional disclosures, please click here.