Immunotherapy is relatively new in the biotech space, but has already seen commercial success. Marketed immunotherapeutics include inhibitors such as Humira (adalimumab; AbbVie Inc. [ABBV:NYSE]), for autoimmune diseases such as rheumatoid arthritis, plaque psoriasis and ulcerative colitis, and Erbitux (cetuximab; Eli Lilly and Co. [LLY:NYSE]), for head-and-neck and metastatic colon cancer. Other big players in the immunotherapy field include Bristol-Myers Squibb Co. (BMY:NYSE) and Genentech/ Roche Holding AG (RHHBY:OTCQX), developer of blockbusters Avastin (bevacizumab; 2014 sales of ~$8.6 billion [$8.6B]) and Rituxan (rituximab; 2014 sales of ~$6.9B).

These approved therapies home in on targets that are either in the microenvironment surrounding the cell or on the cell membrane, and have shown great efficacy in the treatment of a variety of diseases. But researchers and sector analysts consider the interior of the cell the ultimate target—or, as Frost & Sullivan analyst Dorman Followwill dubs it, the "Holy Grail" of cancer treatment.

"Inovio Pharmaceuticals Inc. generated very positive and encouraging clinical data from a Phase 2b trial of VGX-3100."—Ram Selvaraju

Think of a cancer cell as a castle surrounded by a moat. You can lay siege outside the walls, attack the walls themselves, or breach the walls and take out the command center. The first two modes of attack can be successful, but a comeback could be staged if defenses are rebuilt from inside. By taking out the core, everything crumbles. Better yet, nothing is left to stage a comeback with. Cancer cured.

To find out more about the promise of intracellular immunotherapies, both for patients and investors, The Life Sciences Report spoke with Followwill, Rodman & Renshaw analyst Ragharum "Ram" Selvaraju, Chen Lin, publisher of the popular investment newsletter What Is Chen Buying, What Is Chen Selling?, Dr. J. Joseph Kim, CEO of Inovio Pharmaceuticals Inc. (INO:NASDAQ), and Henry Ji, president and CEO of Sorrento Therapeutics Inc. (SRNE:NASDAQ), which recently launched a new collaboration focused on delivering therapeutics intracellularly.

"If everything plays out through the clinical trials process, that will position Sorrento Therapeutics Inc. as one of the greatest biotechs in history."—Dorman Followwill

Ji draws parallels between immunotherapeutic targets and real estate. But instead of "location, location, location," it's all about "target, target, target."

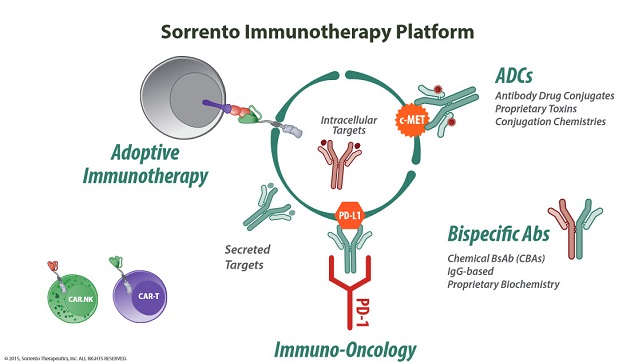

"Scientists have been looking for ways to build inside the cell for the last 30 years. This is the biggest frontier," Ji explained. His company's new joint venture with City of Hope National Medical Center, a respected research and treatment hospital in Southern California, is called LA Cell Inc. The venture is focused on "the development of groundbreaking cell-penetrating antibody therapies" that provide access to the disease-causing proteins located inside the cell.

Engineering Intracellular Immunotherapies

Courtesy of OncoSec Medical Inc.

Selvaraju and Followwill provided nuanced explanations of how an intracellular approach could work against cancer and other diseases. By triggering autologous immunotherapy within the cellular structure itself, the oncoproteins in the cell are exposed to cytotoxic drugs and the body's own immunological weaponry.

"Cancer cells tend not to be red-flagged by the immune system, but autologous (generated within the patient's body) immunotherapy would unmask the cells so that the immune system could then attack," Followwill explained. "The Holy Grail in oncology therapeutics is to find a way to trigger the body's own immune responses against cancer cells wherever they happen to be presenting."

"Inovio Pharmaceuticals Inc. has an interesting technology; the therapy has a two-sided aspect to it." —Dorman Followwill

Targeted immunotherapeutic monoclonal antibodies already on the market "are known to be quite effective in the treatment of cancer," Selvaraju said. These drugs now act on targets outside the cell. The problem? They lose effectiveness over time. "There is wide-ranging evidence that resistance can develop against these antibodies," Selvaraju said.

But if antibodies can be delivered intracellularly, Followwill and Selvaraju believe they'd be better able to kill cancer cells. “If they can trigger the autologous immunotherapy within the cell structure itself, then I think we've taken a major leap forward," Followwill said.

Several companies are looking at ways to penetrate the cell membrane and expose the ideal targets within. Sorrento and LA Cell, for example, are developing monoclonal antibodies against the same targets that have been effectively addressed by Herceptin (traztuzumab; Roche) and Rituxan, "the idea being that these new, next-generation, engineered antibodies will hit the targets both on the cell and intracellularly. This is important because in vitro data and some testing in animal models indicate that these new, next-generation drugs retain cell-killing, or cytotoxic, effectiveness," Selvaraju said.

"For a therapy from Sorrento Therapeutics Inc. I would look for a 505(b)(2) pathway." —Chen Lin

Two other companies, Inovio Pharmaceuticals and OncoSec Medical Inc. (ONCS:NASDAQ), are developing therapies that breach the cell membrane using electrical pulses, opening the door for delivery of their therapeutics.

Selvaraju believes the potential for retained efficacy through immunotherapy "creates a very, very broad array of future product development opportunities."

"If you can target and treat inside the cell, that opens a whole dimension," Lin agreed. "If this is as successful as we hope, it will be like the dawn of the Internet age, but for medicine. We can use intracellular immunotherapeutic technology, potentially, to kill many, many diseases and save millions and millions of people."

Companies in the Field

Courtesy of Sorrento Therapeutics

Courtesy of Sorrento Therapeutics

Followwill, Selvaraju, and Lin are all following the technology being developed by Sorrento Therapeutics' LA Cell Inc. joint venture.

"We, as a firm, have been watching Sorrento since its inception, because we've been looking at the monoclonal antibody field for a long time," Followwill said. The fact that Sorrento has compiled an extensive monoclonal antibody (mAb) library and patent protection—Ji said his company's goal is to possess "the #1 antibody library in the world"—means it has the ability and freedom to generate novel therapeutics for a wealth of targets.

"Intracellular immunotherapy is the 'Holy Grail' of cancer treatment."—Dorman Followwill

Sorrento's chemical approach to intracellular immunotherapy does have competition. Both Inovio (~$454 million [$454M) market cap) and OncoSec (~$39M market cap) are hoping to develop technologies that penetrate the cell membrane. These two companies, in Selvaraju's view, "are very closely related." The management teams "share bloodlines," and their technology platforms both employ electrical means to gain access to insides of cells.

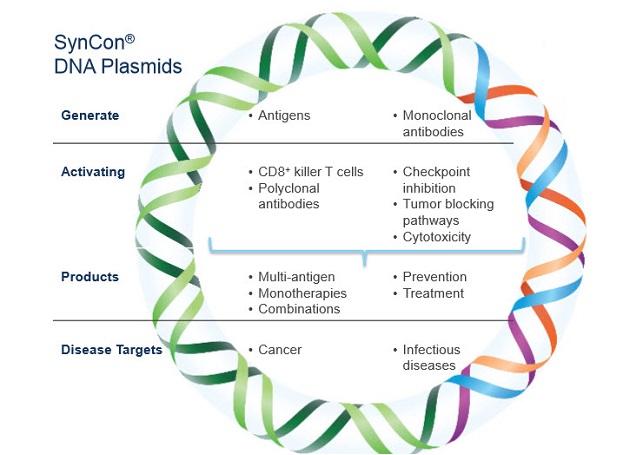

But they differ in significant ways, the analyst explains. Inovio is developing "a suite of DNA vaccines" that, when delivered to patients, "effectively induce immune cell activation by getting tumor cell antigens to be expressed at higher levels, effectively creating an endogenous immune response within the patient." Electroporation is employed to breach the cell membrane and insert the vaccine.

Followwill finds Inovio's use of electroporation and vaccines intriguing. "It's a very interesting technology," he said. "Is it a technology that could trigger autologous immunotherapy? I would say possibly. I like the fact that it's not only immune therapy but also a vaccine. The therapy has a two-sided aspect to it."

"We should see Sorrento Therapeutics Inc.'s first investigational new drug (IND) application filed in 2016; there is enough evidence for investors to at least be intrigued."—Ram Selvaraju

Inovio generated some "very positive and encouraging clinical data from a Phase 2b trial of VGX-3100, which is its lead drug candidate for the treatment of cervical cancer" in late 2014, Selvaraju said. The company is also active in HIV and hepatitis infections.

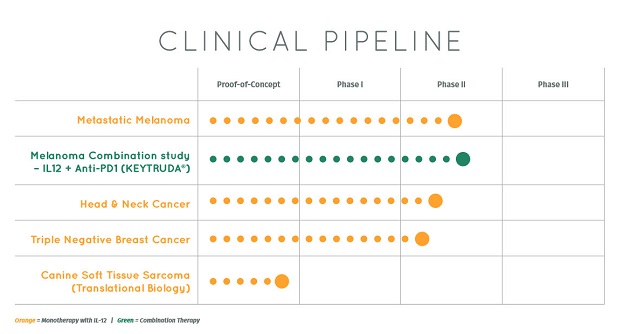

OncoSec is trying to increase the expression of interleukin-12 (IL-12), "a well-known pro-inflammatory cytokine found in and around the tumor itself." Selvaraju said. "If you boost IL-12, it basically acts as a chemo-attractant for the immune cells. It's like a dog's scent and a fox—the IL-12 is the fox drawing the dog to a specific site of the tumor, the dog in this context being the immune cells."

The ImmunoPulse IL-12 technology has already demonstrated activity in Merkel cell carcinoma in one Phase 2 study. And in metastatic melanoma, Selvaraju said, "the activity appears to be quite intriguing because the company saw a number of complete responses. I believe there were four complete responses, and a number of partial responses, as well as some stable disease."

What OncoSec and Inovio are developing is very different from what Sorrento and LA Cell are doing, Selvaraju added. "Sorrento is applying an extrinsic factor—the engineered monoclonal antibodies—and OncoSec and Inovio are trying to induce an intrinsic immune response against the tumor."

The Investment Proposition

All these companies, given their early-stage status and disruptive technologies, are primed for partnerships with larger biotechs or big pharma.

Lin, being "very focused on the investment perspective," is a proponent of this thesis. "Because this target is so big and has the potential to cure so many different diseases, as it becomes a new center of the industry, I expect that major pharma will get involved, either through collaborations or licensing technologies," he said.

Followwill agreed. "I think the big milestone for any one of these companies is when it signs a big collaboration or a big deal with one of the Top 10 pharma companies. That's your ultimate market validation."

Sorrento's management, Selvaraju noted, "has been very clear it views the company as an idea generator, as a relentless innovator." He sees Sorrento as "emblematic of all three companies in that they are going to wind up seeking and potentially establishing significant strategic partnerships geared toward the commercialization of their individual specific therapeutic entities."

"If we can trigger autologous immunotherapy, then we can start to use a different word in the same sentence with cancer. We can start using the word cure."—Dorman Followwill

Striking a collaboration—for instance, if Sorrento can hook up with Celgene Corp. (CELG:NASDAQ)—"is something that investors should watch for very closely," Selvaraju added. "Obviously, the faster these companies can get collaboration agreements in place—the faster these companies can validate their technology platforms by entering into these kinds of strategic agreements—the better the stocks are going to perform."

Another promising aspect of the immunotherapy proposition, as it pertains to Sorrento particularly, is potentially quicker access to the market, according to Lin. "For a therapy from Sorrento, I would look for [a] 505(b)(2) pathway," he said.

Management should always factor into investment decisions. Sorrento's management and ethic has been integral to its success, and is part of what makes it an attractive investment, in Followwill's view. Reflecting on a 2013 visit to the company's headquarters in San Diego, he noted Sorrento had a "full pipeline of oncology candidates. It was really impressive to me. And it had achieved that with a mere 18 employees." That kind of "frugal innovation," which is badly needed by big pharma, sets the company up for continued success, he said.

"This is what pharma 2.0 needs to look like—guys that are churning out phenomenal pipelines of new, innovative products with relatively small human capital but genuine innovation, genuine creativity," he said.

Leadership is also key, Followwill continued. In Sorrento's CEO, Ji, for example, "you have both scientific brilliance and commercial acumen. He's really built a company that I think investors should watch more than any other in the space right now. . .Frankly, if everything plays out through the clinical trials process, that will position the company as one of the greatest biotechs in history."

In terms of milestones, "in the case of Sorrento and LA Cell, this is very early-stage work," Selvaraju said. "Nothing has been progressed into the clinic. I would anticipate that we should see the first investigational new drug (IND) application filed [in 2016], and potentially the first clinical development milestones reached a year after that." But, he added, "There is enough evidence for investors to at least be intrigued."

Courtesy of Inovio Pharmaceuticals

For OncoSec and Inovio, there are some nearer-term milestones. "From our perspective," Selvaraju said, "OncoSec is potentially earlier stage than Inovio, but the ImmunoPulse IL-12 technology-based agent for metastatic melanoma has generated Phase 2 results. This agent could generate additional results from the Phase 2 study within the coming months."

Selvaraju said Inovio's DNA technology could potentially generate pivotal data within the next 12–18 months. "If that's the case, then Inovio would be in a very good position to potentially advance to the formal regulatory filing of its first DNA vaccine," he said.

Additionally, Inovio plans to move "into the domain of what it calls DNA monoclonal antibodies," Selvaraju said. "Essentially, it plans to introduce the DNA and coding of a monoclonal antibody into the patient, and trigger the body of the patient to make the antibody. In effect, the technology primes the patient into his/her own bioreactor." The company is using that approach primarily on highly resistant bacterial infections. Selvaraju expects Inovio could provide proof-of-concept data for that technology by the end of 2016.

Dr. J. Joseph Kim, CEO of Inovio, said, "Inovio’s SynCon DNA-based immunotherapies enhance the body’s existing mechanisms to tackle cancers and infectious diseases, and we can uniquely target any of the specific diseases in these categories. Successful commercialization represents market potential of many tens of billions of dollars. This is not just the glint of an eye. Our Phase 2 data showing best-in-class killer T-cell generation in the body, correlated to efficacy, was recently published in The Lancet. Inovio will launch a Phase 3 study of this lead product this year for HPV-related cervical dysplasia. We see the potential for the first product approvals over the next few years."

All three experts noted that investors considering adding intracellular immunotherapy companies to their portfolios should be prepared for the long haul. Selvaraju expects that immunotherapies will start in the marketplace as "the final option—the last line of defense—because they're the newest agents." However, if drugs delivered intracellularly "provoke complete responses and have high objective response rates clinically, then there's no reason why they couldn't potentially gradually be elevated up the food chain."

The Promise of Intracellular Immunotherapies

In the end, all the experts agree that the promise of intracellular immunotherapies and the companies developing them is not just about investment opportunity.

"There's an overarching human good here," Followwill said. "If we can finally truly trigger autologous immunotherapy, then we can start to use a different word in the same sentence with cancer. We can start using the word cure, as opposed to therapy, regimen, stage, and all the typical language of oncology. If we can truly get the Holy Grail of autologous immunotherapy triggered, then we can take a quantum leap forward in the field."

A founding member of Frost & Sullivan's global Growth Consulting enterprise, Dorman Followwill has more than 30 years of experience, both in the field of management consulting and as a manager in the nonprofit sector. He began his career as a management consultant with Marakon Associates in San Francisco. He has worked for Frost & Sullivan for more than 16 years, in both the U.S. and in Europe, having overseen the global Growth Consulting enterprise in its infancy, as well as managing the most profitable business unit in the 54-year history of the firm. Followwill currently serves as a partner on the Partner Leadership Team overseeing the European practice as a whole, as well as managing the Healthcare practice in Europe, Israel and Africa. He has managed a wide variety of consulting engagements with Frost & Sullivan, including acquisition analyses and emerging market analyses for GE Healthcare, long-term strategic planning projects for a division of Merck, quarterly product tracking to the brand level over more than 11 years for Bayer, market size and epidemiology analysis for GlaxoSmithKline, multiple product analyses for Philips Medical, as well as a host of other projects for clients such as 3M, Medtronic, Johnson & Johnson, Siemens Medical Systems, IBM, Hewlett Packard, Roche Diagnostics, Hitachi and many others. He has executed coaching workshops focused on mega trends-driven innovation over the past five years with Daiichi Sankyo, Roche Diagnostics, Merck Millipore, Honeywell, Endress + Hauser, Shell, GE Healthcare and Hitachi. Followwill had a bachelor's degree in management of organizations from Stanford University.

Chen Lin writes the popular stock newsletter What Is Chen Buying? What Is Chen Selling?, published and distributed by Taylor Hard Money Advisors, Inc. While a doctoral candidate in aeronautical engineering at Princeton, Chen found his investment strategies were so profitable that he put his Ph.D. on the back burner. He employs a value-oriented approach and often demonstrates excellent market timing due to his exceptional technical analysis.

Raghuram "Ram" Selvaraju's professional career started at the Geneva-based biotech firm Serono in 2000, where he discovered the first novel protein candidate developed entirely within the company. He subsequently became the youngest recipient of the company's Inventorship Award for Exceptional Innovation and Creativity. Selvaraju started in the securities industry with Rodman & Renshaw as a biotechnology equity research analyst. He was the top-ranked (#1) biotech analyst in The Wall Street Journal's "Best on the Street" survey (2006) and went on to become head of healthcare equity research at Hapoalim Securities, the New York-based broker/dealer subsidiary of Bank Hapoalim B. M., Israel's largest financial services group. While at Hapoalim, Selvaraju was regularly featured in The Wall Street Journal, Barron's, BioWorld Today, and Reuters/AP. He was also a regular guest on the Bloomberg TV program "Taking Stock," appeared with Bloomberg TV's on-air correspondents Betty Liu and Gigi Stone and was a guest on CNBC's "Street Signs with Herb Greenberg."

Read what other experts are saying about:

Want to read more Life Sciences Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

DISCLOSURE:

1) Tracy Salcedo prepared this article for Streetwise Reports LLC, publisher of The Gold Report, The Energy Report and The Life Sciences Report, and provides services to Streetwise Reports as an independent contractor. She owns, or her family owns, shares of the following companies mentioned in this interview: None.

2) The following companies mentioned in the interview are sponsors of Streetwise Reports: Inovio Pharmaceuticals Inc., Sorrento Therapeutics Inc. The companies mentioned in this interview were not involved in any aspect of the post-interview editing so the experts could speak independently about the sector. Streetwise Reports does not accept stock in exchange for its services.

3) Ram Selvaraju: I own, or my family owns, shares of the following companies mentioned in this interview: None. I personally am, or my family is, paid by the following companies mentioned in this interview: None. My firm does not own 1% or more of any of the underlying securities or derivatives thereof of any following companies mentioned in this interview: Inovio Pharmaceuticals Inc., Sorrento Therapeutics Inc., OncoSec Medical Inc. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I determined and had final say over which companies would be included in the interview based on my research, understanding of the sector and interview theme. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

4) Dorman Followwill: I own, or my family owns, shares of the following companies mentioned in this interview: None. I personally am, or my family is, paid by the following companies mentioned in this interview: None. My company has a financial relationship with the following companies mentioned in this interview: None. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I determined and had final say over which companies would be included in the interview based on my research, understanding of the sector and interview theme. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

5) Chen Lin: I own, or my family owns, shares of the following companies mentioned in this interview: Sorrento Therapeutics Inc. I personally am, or my family is, paid by the following companies mentioned in this interview: None. My company has a financial relationship with the following companies mentioned in this interview: None. I was not paid by Streetwise Reports for participating in this interview. Comments and opinions expressed are my own comments and opinions. I determined and had final say over which companies would be included in the interview based on my research, understanding of the sector and interview theme. I had the opportunity to review the interview for accuracy as of the date of the interview and am responsible for the content of the interview.

6) Interviews are edited for clarity. Streetwise Reports does not make editorial comments or change experts' statements without their consent.

7) The interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer.

8) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.