In a Feb. 2 research note, Mackie Research Capital Corp. analyst Andre Uddin reported that Algernon Pharmaceuticals Inc. (AGN:CSE; AGNPF:OTCQB; AGW:FSE) launched a clinical program to repurpose the psychedelic compound DMT, or dimethyltryptamine, as a possible stroke treatment.

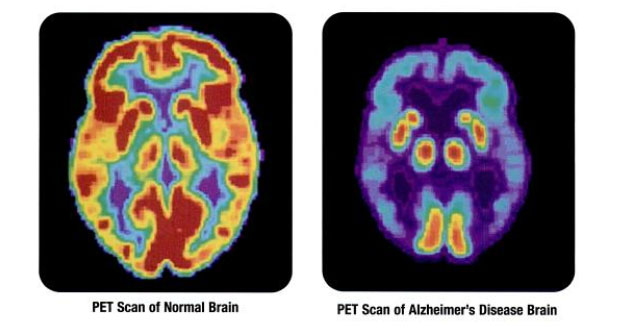

Uddin explained that based on successful animal trials, Algernon hypothesizes that DMT could bring about neurogenesis and neuroplasticity in humans, thus helping brain healing and patient recovery after a stroke and, potentially, other brain injury. Accordingly, the company intends to determine and test an effective and nonhallucinogenic microdose of DMT in ischemic stroke patients.

The next steps in this program, the analyst noted, are for Algernon to continue its preclinical studies of DMT, request a meeting with the U.S. Food and Drug Administration for guidance on moving forward and then submit to the agency an investigational new drug application. The Canadian company also intends to file a clinical trial application with Health Canada.

"A Phase 1 trial with DMT for stroke could commence in H2/21," Uddin highlighted.

He pointed out that Algernon's other clinical programs have catalysts approaching. Final data from its Phase 2b trial of ifenprodil in COVID-19 are expected at the end of February. Early results from its Phase 2b trial of ifenprodil in chronic cough and idiopathic pulmonary fibrosis are anticipated in about Q2/21 or Q3/21, with complete data to follow, likely in Q4/21.

Uddin also reported Algernon's financial results for Q1/21, the quarter ended Nov. 30, 2020. The company did better during those three months than Mackie expected, posting a net loss of $3.4 million, or $0.02 per share, versus $4.4 million, or $0.03 per share. At quarter's end, Algernon had $2.6 million in cash and no debt.

Mackie has a Speculative Buy rating and an CA$0.80 per share target price on Algernon. The stock is trading now at about CA$0.26 per share.

Read what other experts are saying about:

Disclosure:

1) Doresa Banning compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Algernon. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Algernon, a company mentioned in this article.

Disclosures from Mackie Research Capital Corp., Algernon Pharmaceuticals Inc., Update, February 2, 2021

RELEVANT DISCLOSURES APPLICABLE TO COMPANIES UNDER COVERAGE:

Relevant disclosures required under IIROC Rule 3400 applicable to companies under coverage discussed in this research report are available on our web site at www.mackieresearch.com.

1. This issuer has generated investment banking revenues for MRCC.

ANALYST CERTIFICATION

Each analyst of Mackie Research Capital Corporation whose name appears in this report hereby certifies that (i) the recommendations and opinions expressed in this research report accurately reflect the analyst’s personal views and (ii) no part of the research analyst’s compensation was or will be directly or indirectly related to the specific conclusions or recommendations expressed in this research report.