McAlinden Research Partners estimates it may be only a matter of time before psychedelics become part of a biotech boom.

Psychedelic drugs and therapies continue to show promise as a form of treatment for a wide variety of mental health disorders. Recent trials testing the use of psilocybin have shown effectiveness in curing or alleviating symptoms of anxiety, depression and PTSD, leading cities including Denver and Seattle to decriminalize the drug.

Psychedelics are likely to ride on the coattails of cannabis, as both drugs possess notable medicinal benefits and face a loosening regulatory environment. Investment into psychedelic treatments, commonly referred to as the ‘shroom-boom’, is forecast to expand as additional trial results are announced and the alternative medicine sheds long-held stigmatization.

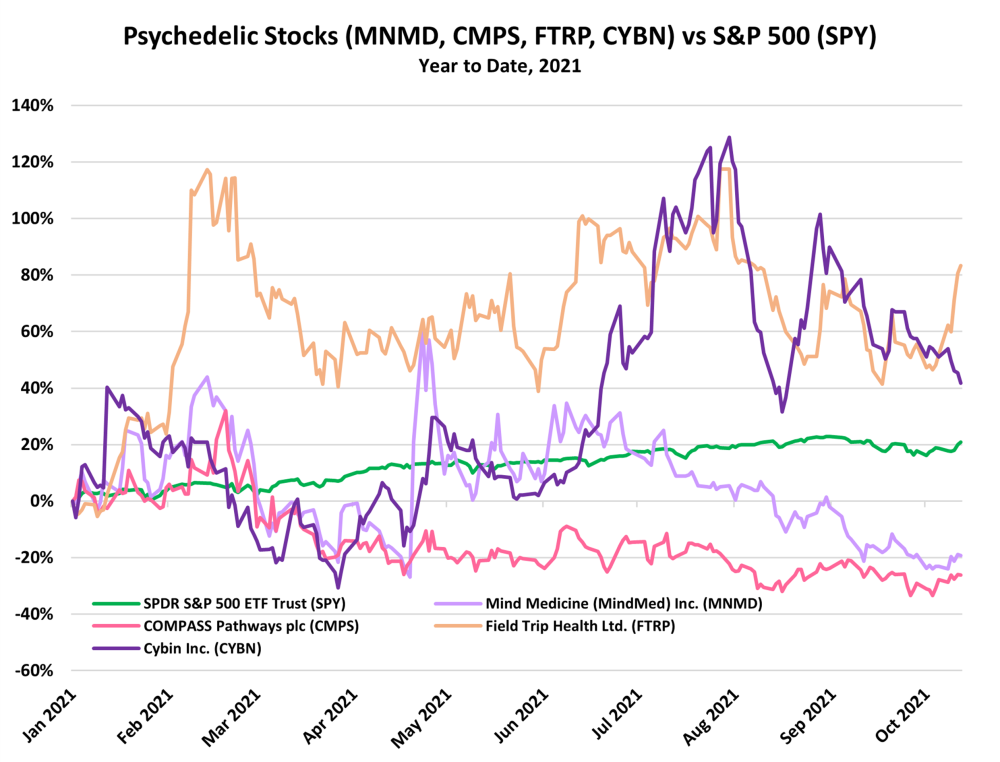

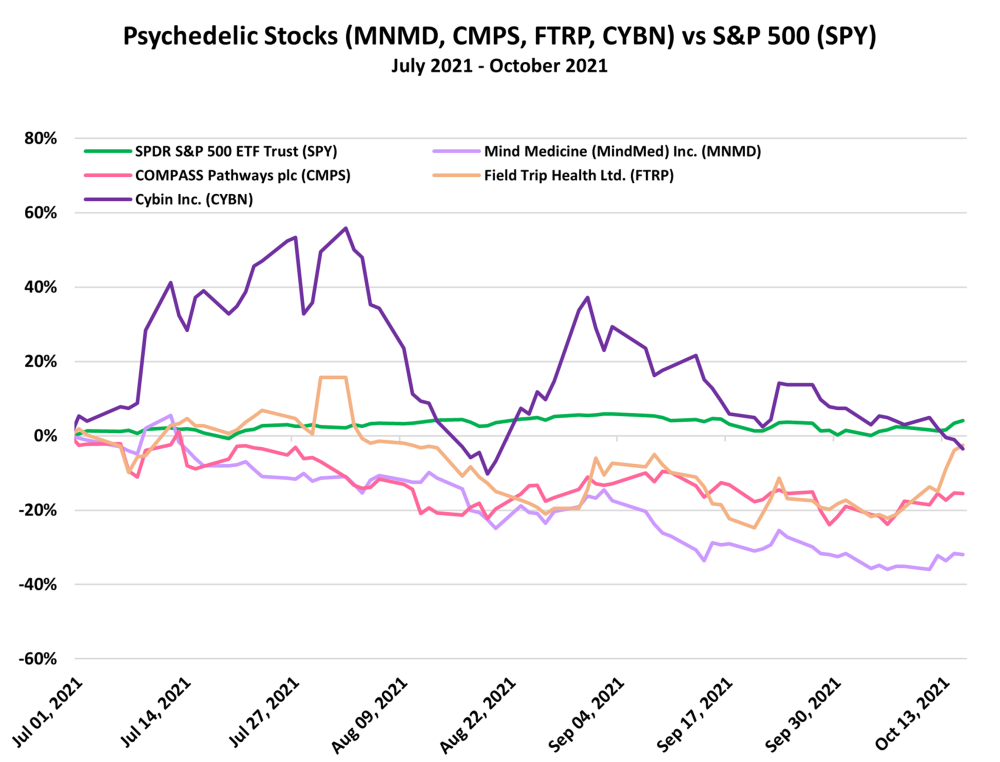

Related Stocks: Mind Medicine (MindMed) Inc. (MNMD), COMPASS Pathways plc (CMPS), Field Trip Health Ltd. (FTRP), Cybin Inc. (CYBN)

Psychedelic Trials Continue to Provide Promising Results

Psychedelics are beginning to shed their stigmatization as the drugs prove to be a remarkably effective form of medicine, treating a plethora of mental illness in addition to physical ailments.

MRP highlighted psychedelics ability to treat depression, anxiety, and post-traumatic stress disorders last spring. Now, recent trial results have shown that the medicinal value of LSD, MDMA and psilocybin is even greater than previously thought.

To receive all of MRP's insights in your inbox Monday–Friday, follow this link for a free 30-day trial. This content was delivered to McAlinden Research Partners clients on October 18.

A clinical trial at St. Vincent’s hospital in Melbourne, Australia, is using a common psychedelic called psilocybin to help treat 40 patients with terminal conditions such as chronic obstructive pulmonary disease and motor neuron disease, per The Guardian. The trial follows successful studies from the United States that showed ‘overwhelming positive life changes’ in late-stage cancer patients dealing with severe anxiety and depression.

Another successful study of patients struggling with PTSD, conducted by the Multidisciplinary Association for Psychedelic Studies, found that 67% of participants who received three treatments of MDMA assisted therapy no longer qualified for a PTSD diagnosis, while 88% experienced a clinically significant reduction in symptoms.

Scientists are hopeful that the new waves of research will help spark further psychedelic acceptance and show that common SSRIs used to treat anxiety and depression are simply not effective enough.

While psychedelics show promise for treating mental health disorders, new results from trials testing the drugs for physical conditions could certainly help accelerate a potential psychedelic renaissance.

PsyPost recently highlighted a paper published in Scientific Reports, concluding that patients that use psychedelics just once have lower odds of heart disease and diabetes as users tended to cut alcohol use and exercise more after trying psilocybin. The new findings show that these drugs can be used to help promote healthier lifestyles for patients that have a higher likelihood of cardiometabolic diseases, which is likely to spur further research into the link between psychedelics and cardiometabolic health.Further, Tryp Therapeutics is leading the wave of drug development beyond mental health and into the psychedelic treatment of chronic pain and eating disorders in their latest clinical trials.

The untapped potential of psychedelic medicine has not only helped advance new research, but investment has recently surged as investors are rushing to capitalize on the upcoming ‘shroom-boom’.

Investment Rises and Decriminalization Spreads

The psychedelic market is forecast to grow at an impressive rate as investors continue to fund both startups and publicly traded companies. Research from Data Bridge Market Research projects the psychedelic market to grow at a 13.3% CAGR, rising from $2.8 billion in 2020 to $7.57 billion in 2028. Further, the aggregate value of publicly traded psychedelic companies now exceeds $7 billion, indicating there are a lot of investors betting on the future of these drugs.

Similarly, the first investment fund focused on psychedelic healthcare recently launched in the United Kingdom, per Green Entrepreneur. The fund could drive further interest in the sector across Europe, potentially leading to a greater number of investment options in psychedelics.

According to Bloomberg, Citi Group recently put out a bullish statement for psychedelic stocks, stating that academic studies over the last 20-25 years show the potential for therapeutic benefit under the supervision of a medical provider. Citi said the recent rise in mental health disorders from the COVID-19 pandemic have helped the psychedelic market stage a comeback.

The Los Angeles Times recently reported that dozens of investment firms have begun funding the psychedelic space,with some major names advocating for the drugs. Elon Musk, Peter Thiel and Steve Cohen are just a few that have either publicly advocated for psychedelics or bet on startups and funded research projects.

Smaller companies are also betting on a psychedelic gold rush. Vox reports that a company called Field Trip is opening clinics across the country where they administer ketamine treatments. The company recently went public, and announced it will be building 75 centers for psychedelic therapy over the next three years, betting that a wider audience will accept LSD and psilocybin as game-changing medications in the future.

Major cities have decriminalized psychedelics in some capacity, boosting investor interest even further. Per Marijuana Moment, Seattle recently became the largest city to decriminalize non-commercial psychedelic usage, allowing its residents to cultivate and share psilocybin mushrooms.

Denver decriminalized psilocybin mushrooms in 2019, while Detroit and Washington DC appear to be next in line to decriminalize these drugs. It’s likely additional cities will follow suit as public perception of psychedelics shifts, potentially riding the coattails of cannabis legalization across the country.

Psychedelics show remarkable promise for treating both mental and physical conditions, as new trials are concluded with significant results. Hedge funds and startups alike have noted the vast medicinal potential these drugs have and are likely to invest a substantial amount of capital into the market over the next few years to contribute to its growth. It may be only a matter of time before psychedelics become part of a biotech boom.

Originally published October 18, 2021

McAlinden Research Partners (MRP) provides independent investment strategy research to investors worldwide. The firm's mission is to identify alpha-generating investment themes early in their unfolding and bring them to its clients' attention. MRP's research process reflects founder Joe McAlinden's 50 years of experience on Wall Street. The methodologies he developed as chief investment officer of Morgan Stanley Investment Management, where he oversaw more than $400 billion in assets, provide the foundation for the strategy research MRP now brings to hedge funds, pension funds, sovereign wealth funds and other asset managers around the globe.

Disclosures:

1) McAlinden Research Partners disclosures are below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

McAlinden Research Partners:

This report has been prepared solely for informational purposes and is not an offer to buy/sell/endorse or a solicitation of an offer to buy/sell/endorse Interests or any other security or instrument or to participate in any trading or investment strategy. No representation or warranty (express or implied) is made or can be given with respect to the sequence, accuracy, completeness, or timeliness of the information in this Report. Unless otherwise noted, all information is sourced from public data.

McAlinden Research Partners is a division of Catalpa Capital Advisors, LLC (CCA), a Registered Investment Advisor. References to specific securities, asset classes and financial markets discussed herein are for illustrative purposes only and should not be interpreted as recommendations to purchase or sell such securities. CCA, MRP, employees and direct affiliates of the firm may or may not own any of the securities mentioned in the report at the time of publication.

Charts and graphs provided by McAlinden Research Partners.