Clinical stage biopharmaceutical company Nurix Therapeutics Inc. (NRIX:NASDAQ), which is focused on developing targeted protein modulation drugs to treat cancer and other diseases, yesterday announced Q1/22 financial results for the period ended February 28, 2022 and provided an update on business operations in the quarter.

Therapeutics' President and CEO Arthur T. Sands, M.D., Ph.D. commented, "In the first quarter, we have made both clinical and regulatory advances in each of our four drug programs including our lead BTK degrader NX-2127 which position us well to provide important proof of concept data across our pipeline throughout the remainder of 2022…With the recent dosing of our first patient in the DeTIL-0255 Phase 1 program, we have expanded the reach of our protein modulation platform to now include drug-enhanced cell therapy."

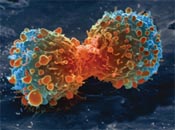

The company reported on recent developments at the company and advised that it had commenced with dosing the first patient enrolled in its DeTIL-0255 clinical study. The Phase 1 trial is being conducted in patients diagnosed with advanced gynecologic cancers, including ovarian cancer, cervical cancer, and endometrial cancer at multiple U.S. locations. Nurix highlighted that this signifies a major milestone for the company and "represents the first application of targeted protein modulation in the field of cell therapy."

The firm also indicated that the U.K. Medicines and Healthcare products Regulatory Agency (MHRA) recently granted an innovative medicine designation for its NX-1607 for treating patients with advanced solid tumors.

The company mentioned that it is conducting a Phase 1 clinical trial of NX-2127, which it stated it the leading drug candidate from its protein degradation portfolio, at multiple clinical sites in the U.S. The firm advised that "NX-2127 is an orally bioavailable degrader of BTK with immunomodulatory drug (IMiD) activity for the treatment of patients with relapsed or refractory B-cell malignancies." The company stated that preclinical data suggests that NX-2127 potentially offers dual action ability to degrade BTK and IMiD neosubstrates and thus "enhance multiple mechanisms of tumor killing."

The company stated that a second candidate in its protein degradation portfolio called NX-5948 is also currently being evaluated in a Phase 1 study in the U.K. in adults with relapsed or refractory B-cell malignancies. The first dosing of patients expected to begin in H1/22.

Nurix also provided updates on two other ongoing Phase 1 studies including its NX-1607, an E3 ligase inhibitor for use in a wide range of solid tumor types and DeTIL-0255, a drug-enhanced adoptive cellular therapy for adult women with gynecological malignancies such as ovarian, cervical, and endometrial cancer.

The company stated that during Q1/22 it recorded collaboration revenue of $9.6 million, compared to $5.0 million in Q1/21. The firm indicated that the increase was mostly due to revenue recognition adjustments and milestones achieved under its research partnership activities with Gilead Sciences Inc. (GILD:NASDAQ) and Sanofi SA (SNY:NYSE).

The company noted that in addition, in Q1/22 it has received a $6.0 million milestone payment from Gilead and expects to receive another $2.0 million payment from Sanofi later in Q2/22.

The firm state that it spent $43.1 million on R&D in Q1/22, versus $23.0 million during Q1/21. The company attributed the increase mostly to rises in compensation and related personnel costs (+$7.6 million) and increases in supply, contract research, contract manufacturing and clinical trial costs (+$8.6 million).

The company posted a net loss of $42.5 million, or a net loss of $0.95 per share in Q1/22, compared to a net loss of $24.3 million, or a net loss of $0.63 per share in Q1/21.

Nurix advised that as of the end of Q1/22 it held $385.7 million in cash, cash equivalents and investments on its balance sheet.

In a separate new release today, Nurix Therapeutics Inc. (NRIX:NASDAQ) announced that it will making "a presentation of preclinical data that support the clinical development of investigative therapies NX-2127 and DeTIL-0255, for the treatment of B-cell malignancies and solid tumors, respectively, at the American Association for Cancer Research (AACR) Annual Meeting," which is being held in New Orleans, La. starting today.

Nurix's Chief Scientific Officer Gwenn M. Hansen, Ph.D. stated, "Our data presentations at the AACR meeting highlight the breadth and potential of our protein modulation platform to create therapies that could be transformative for patients with cancer…These presentations showing the unique activity of two proprietary small molecule protein modulators, NX-2127 and NX-0255, provide clear scientific rationale supporting our ongoing clinical programs for NX-2127 in B-cell malignancies and DeTIL-0255 for solid tumors. We plan to provide clinical updates from both programs in the second half of 2022."

Nurix Therapeutics is biopharma company based in San Francisco, Calif. that concentrates its efforts on finding, developing and commercializing small molecule and cell therapies for cancer and other challenging diseases. The firm's approach to creating treatments is based upon modulating cellular protein levels. The company listed that "its wholly owned pipeline includes targeted protein degraders of Bruton's tyrosine kinase, a B-cell signaling protein, and inhibitors of Casitas B-lineage lymphoma proto-oncogene B, an E3 ligase that regulates T cell activation." The company's drug-candidate pipeline includes therapeutics for treating patients with autoimmune diseases, hematologic malignancies, solid tumors and viral diseases.

Nurix Therapeutics started the day Friday with a market cap of around $594.8 million with approximately 44.85 million shares outstanding and a short interest of about 8.6%. NRIX shares opened slightly higher at $13.31 (+$0.05, +0.38%) over Thursday's $13.26 closing price. The stock traded Friday between $13.25 and $15.457 per share and closed at $14.82 (+$1.56, +11.76%).

| Want to be the first to know about interesting Biotechnology / Pharmaceuticals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Disclosures

1) Stephen Hytha compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

6) This article does not constitute medical advice. Officers, employees and contributors to Streetwise Reports are not licensed medical professionals. Readers should always contact their healthcare professionals for medical advice.